In a financial world buzzing with choices, Tinker Federal Credit Union (TFCU) stands tall, empowering its members with some of the best rates on savings and loans in the industry. Buffeted by competition from big players like Alliant Credit Union, Arrowhead Credit Union, Suncoast Credit Union, and Space Coast Credit Union, TFCU has carved a niche that’s increasingly hard to ignore. With a member-centric philosophy and community commitment, Tinker Federal Credit Union isn’t just keeping pace; it’s leading the way in enhancing financial wellness for everyday Americans.

As the financial landscape continues to shift, the significance of credit unions only grows. They provide essential services that can make a real difference in people’s lives. Let’s take a closer look at seven compelling reasons why Tinker Federal Credit Union is making waves in the sector.

7 Ways Tinker Federal Credit Union Outshines Competitors

1. Exceptional Savings Account Rates Compared to Competitors

One of the primary advantages Tinker Federal Credit Union offers is exceptional savings account rates. TFCU’s current rates rival those offered by Alliant Credit Union, known for its high-yield savings options. While Alliant typically hovers around 1.60% APY, TFCU has recently rolled out a tiered savings account, boasting rates as high as 2.00% APY for balances over $10,000. This not only encourages members to save but builds a sense of financial security, which is crucial in today’s climate.

In a world where savings often feel like a steep uphill climb, TFCU’s rates provide a refreshing perspective. By fostering a culture of savings, Tinker Federal Credit Union ensures that members feel more in-control of their financial futures.

2. Competitive Loan Rates That Benefit Members

When it comes to loans, Tinker Federal Credit Union’s offerings shine brightly. For instance, their mortgage rates currently stand around 3.25%, giving borrowers the opportunity to save significantly compared to competitors like Suncoast Credit Union, which offers rates closer to 3.50%. This difference might seem small on the surface but can translate into thousands of dollars saved over the life of a loan, making a world of difference for homeowners.

Likewise, personal loan rates at TFCU also give members a beneficial edge over peers. This competitive structure not only serves individual financial needs but reinforces TFCU’s status as a truly member-oriented institution.

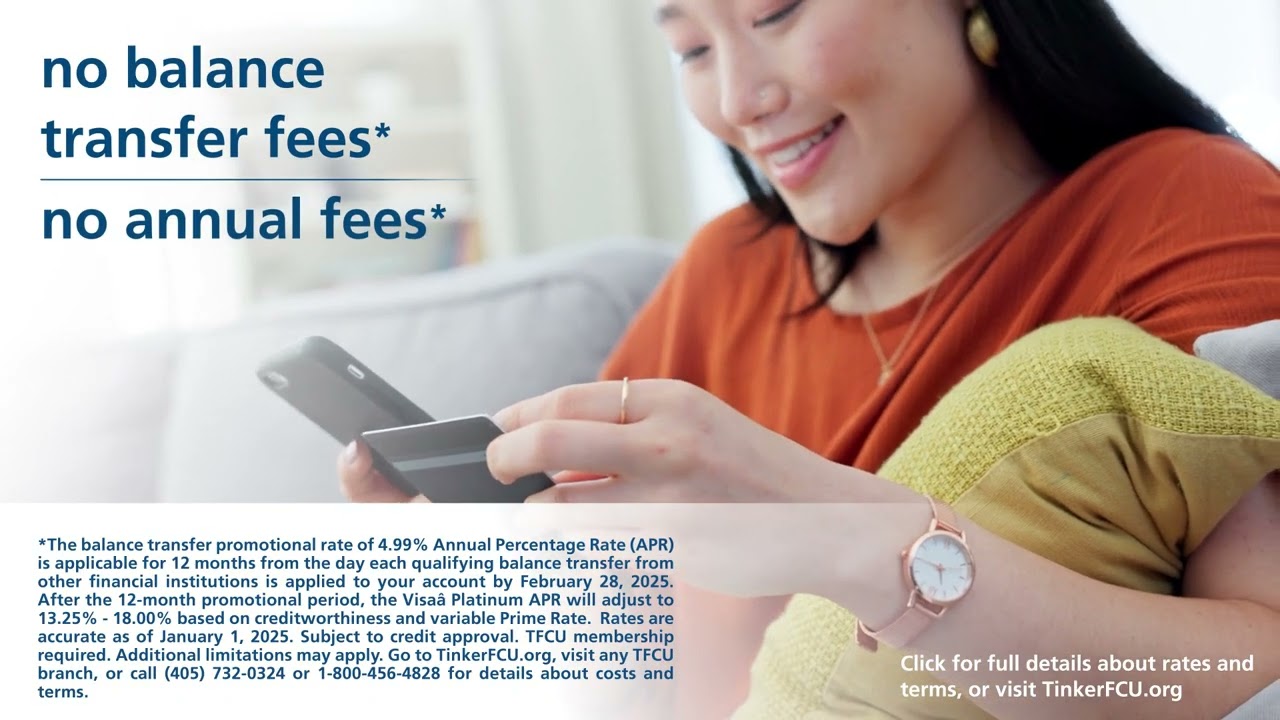

3. No Monthly Fees on Checking Accounts

Let’s face it—monthly fees on checking accounts can be a drain on your wallet. Tinker Federal Credit Union understands this and offers checking accounts with no monthly maintenance fees if certain conditions are met. This is a stark contrast to Space Coast Credit Union, where modest fees can accumulate throughout the year.

By eliminating these fees, TFCU lowers barriers for new members, paving the way for financial inclusion. This commitment not only encourages consistent account usage but fosters a positive financial relationship with members right from the start.

4. Enhanced Online and Mobile Banking Features

In today’s digital-first age, quality online banking is essential. Tinker Federal Credit Union has made substantial investments in technology, resulting in an online and mobile banking experience that often beats out competitors like Alliant Credit Union. With a user-friendly interface, TFCU allows members to seamlessly manage their savings, check account balances, and make transfers.

Moreover, features like budgeting tools and intuitive transaction processes resonate particularly well with a younger, tech-savvy demographic. In this increasingly digital world, Tinker Federal Credit Union is setting a strong example of how technology can empower individuals to take charge of their finances.

5. Member Education Programs: A Worthy Investment

Tinker Federal Credit Union goes above and beyond by offering financial literacy programs that are more inclusive and varied than those at many other credit unions. From saving for college to retirement planning, TFCU tailors educational initiatives that cater to various life stages. This approach sets it apart from competitors like Suncoast Credit Union, providing members the knowledge they need to navigate their financial journeys.

These community initiatives foster a culture of financial responsibility and education, empowering members to make informed decisions about their money. The result? A more financially literate member base that sees the value in maintaining a long-term relationship with TFCU.

6. Flexible Loan Options Catered to the Individual

Flexibility is a hallmark of Tinker Federal Credit Union’s loan offerings. For instance, their car loans not only boast competitive rates but also come with diverse options for loan terms. This is a step up compared to the more rigid offerings from Arrowhead Credit Union. It allows members to choose the loan duration that best suits their individual circumstances.

Such personalization is critical for borrowers, particularly those aiming to find manageable financial commitments. With TFCU, members can take comfort in knowing they have options tailored to their unique financial situations.

7. A Community Focus That Enhances Member Bonding

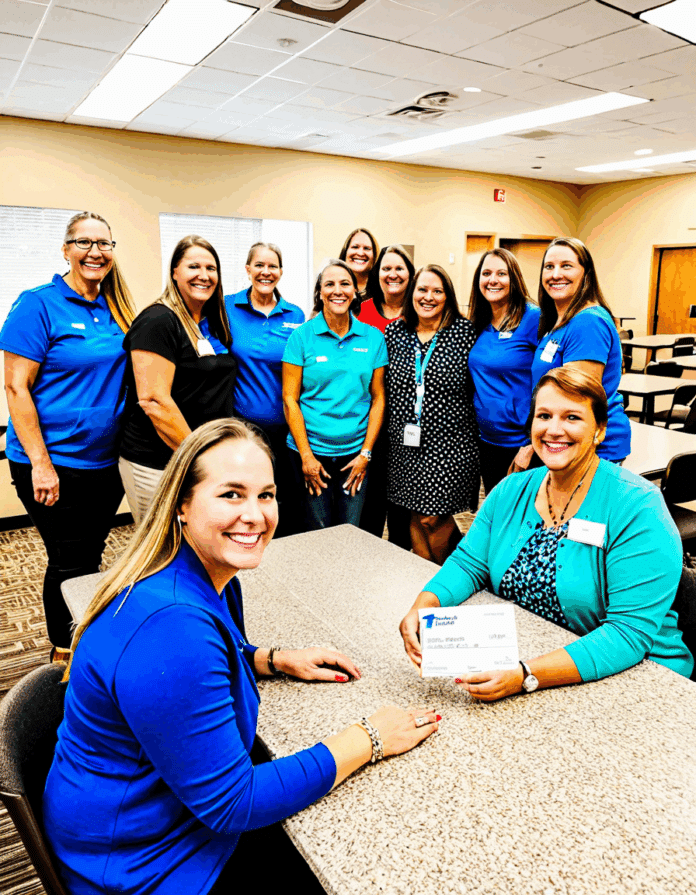

Community involvement is woven into Tinker Federal Credit Union’s fabric, setting it apart from more profit-driven institutions like Space Coast Credit Union. TFCU’s initiatives, including local sponsorships, volunteer opportunities, and scholarship programs, create a deep bond between members and the organization.

This commitment to community not only drives member loyalty but also enhances overall satisfaction. When you partake in a financial institution that genuinely cares for its community, it fosters a sense of belonging and well-being.

Empowering Members Beyond Financial Gains

Tinker Federal Credit Union’s strategy of prioritizing member empowerment through competitive rates and community engagement is revolutionizing its image in the crowded credit union sector. With innovative services and an emphasis on financial education, TFCU is not simply providing financial products but building long-lasting relationships with its members.

As the financial landscape continues to change, credit unions like TFCU that place member benefits above profit are set to thrive. Their unwavering commitment to exceptional service and community involvement highlights the pivotal role Tinker Federal Credit Union plays in the journey toward financial wellness.

In conclusion, if you want to be part of an institution where your financial growth is prioritized, it’s time you consider becoming a member of Tinker Federal Credit Union. Empower yourself with the best rates and community connection—your financial well-being deserves nothing less.

Check The Colts schedule here ! For more global adventure, how about climbing Mt . Everest? And if you’re thinking of dinner, don’t miss an opportunity to try some delicious pork tenderloin. Curious about what’s happening on the screen tonight? Find out What ‘s on Nbc tonight.

Tinker Federal Credit Union: Fun Facts and Trivia

Did You Know?

Tinker Federal Credit Union, rooted in the Oklahoma City area, has a vibrant history that dates back to 1946. Originally founded to serve the employees at Tinker Air Force Base, it’s grown over the decades, welcoming all those who live or work in surrounding communities. This transformation speaks volumes about its commitment to fostering connections. Speaking of community, did you know that Tinker Federal Credit Union is one of the largest credit unions in the United States? Yep, they’ve built a solid reputation while providing members some of the best rates available, particularly when it comes to loans and savings.

A Culture of Giving Back

What’s even more impressive about Tinker Federal Credit Union is its dedication to local charity efforts. With programs that directly benefit education and health initiatives, they’ve put their money where their mouth is—literally! The credit union encourages its members to participate in community service, creating a sense of camaraderie that’s as infectious as the optimism around here. Moreover, they offer a scholarship fund that provides financial aid to local students. Now, isn’t that something to brag about? Plus, they pride themselves on maintaining high member satisfaction rates. A happy member is a loyal member, and Tinker Federal Credit Union definitely gets that.

Financial Savvy for Everyone

And here’s a fun little nugget: Tinker Federal Credit Union was the first in Oklahoma to provide online banking services. Can you imagine? Back in the day, that was cutting-edge! Today, they continue to adapt, making banking more accessible for everyone. They’ve also got a variety of financial education resources available for members, just in case you’re feeling lost in the financial jungle. So, whether you’re eyeing a new car or saving for a dream vacation, Tinker Federal Credit Union has tools to guide you along the way. They really do think of everything!

Tinker Federal Credit Union isn’t just another financial institution; it’s a trusted partner in your financial journey. With community at its core and innovation at every turn, joining Tinker feels like becoming part of a big, supportive family. So, why not take advantage of what they offer?