1. The Essentials of Barclaycard: A Financial Revolution

Barclaycard has long been synonymous with innovation in financial services. Known for pushing boundaries to enhance customer experiences, they’ve fully embraced the digital age. With offerings that extend beyond the confines of traditional credit cards, Barclaycard is at the forefront of transforming how we manage finances. As we step into 2026, their initiatives—such as real-time transaction alerts and contactless payments—have cemented Barclaycard as a crucial player in consumers’ daily financial interactions.

In a world where consumers crave convenience, Barclaycard has risen to the occasion. Their platform not only makes managing money a breeze but also helps users stay informed about their expenditures. As consumers navigate the complexities of modern finance, Barclaycard’s focus on personal finance transformation resonates deeply. As they launch more advanced solutions, they cater to a broad spectrum of financial needs that today’s users demand.

With an ever-increasing emphasis on smart financial habits, Barclaycard continues to redefine the customer experience. The seamless integration of technology in their offerings is more than just an upgrade; it’s a commitment to helping customers achieve their financial goals. Whether you’re planning a trip to Disney World Hotels or setting up a savings plan for a future purchase, Barclaycard is there every step of the way.

2. Top 5 Innovative Features of Barclaycard that Simplify Your Finances

Barclaycard isn’t just about providing a credit card; it’s about revolutionizing financial management. Here are five standout features that highlight Barclaycard’s innovative approach:

3. How Barclaycard’s Technological Innovation is Shaping Consumer Behavior

As consumers’ expectations evolve, so do the tools they use to manage their finances. Barclaycard recognizes this shift and has embraced technological innovation to meet it head-on. The integration of machine learning algorithms analyzes user behavior, enabling personalized solutions that allow for smarter financial choices.

The data paints an optimistic picture: users engaging with Barclaycard’s digital tools have shown up to a 30% improvement in financial management habits. This figure is attributed to their ability to track and visualize spending, encouraging budgeting and saving in ways that traditional methods can’t match.

More than just a financial service provider, Barclaycard is transforming the relationship consumers have with their finances. Through improved tools and features, Barclaycard empowers people to take control of their financial destinies. This wave of innovation simplifies the complexities of finance and makes it easier for everyday consumers to feel confident about their monetary decisions.

4. Real-World Impact: Personal Stories of Financial Transformation through Barclaycard

Perspectives from everyday people reveal the true value of Barclaycard’s innovative features. One family planning a trip to Disney World hotels reported that by utilizing Barclaycard’s budgeting tools, they successfully saved over £1,500 for their trip. This financial foresight let them indulge in memorable extras, like character dining experiences that made their vacation even more special.

Another user, a millennial professional, shared a similar sentiment about Barclaycard’s interest-free payment plans. By utilizing this feature, they were able to afford luxury cruises with MSC without stressing about debt, making their travel dreams a reality while maintaining fiscal health. These real stories emphasize how technology enhances individual financial journeys.

Such examples help us understand the broader impact of Barclaycard’s offerings. They reflect how innovative financial solutions can transform daily lives, enabling customers to enjoy experiences without the usual financial anxiety. People don’t just see Barclaycard as a financial tool; they view it as a partner that supports their aspirations and lifestyles.

5. Looking Ahead: The Future of Financial Innovation with Barclaycard

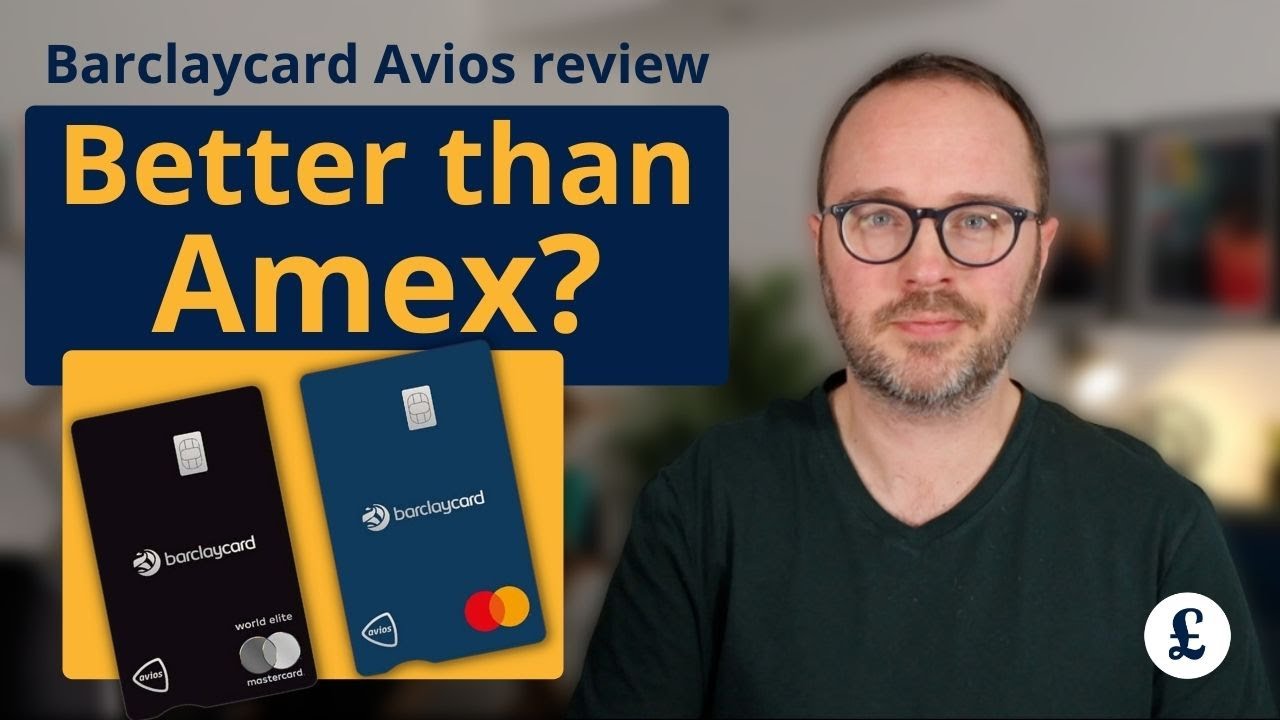

As we gaze into the future, Barclaycard’s commitment to advancing financial technology will play a pivotal role. Trends indicate that the integration of AI and machine learning will only deepen, creating an environment where financial services evolve in real time to meet customer needs. Their collaborations with entities like Eurostar further emphasize how finance and travel intertwine, opening up new avenues for exploration and choice.

The paradigm shift we witness today suggests that financial institutions like Barclaycard are changing the narrative from simply handling transactions to actively fostering customer experiences. This dynamic will continue to evolve as consumer expectations rise, pushing institutions to provide even more personalized offerings.

Barclaycard is positioning itself as an indispensable ally in a world riddled with financial complexities. By continuously innovating and developing tools that empower users, they’re setting a new standard for what it means to manage finances in the modern age. As technology evolves, so will the opportunities that lead individuals toward a brighter, manageable financial future.

In conclusion, Barclaycard isn’t just a credit card—it’s a key player in redefining financial management, enabling consumers to take charge of their financial futures with confidence and ease.

Fun Trivia and Interesting Facts about Barclaycard

The Origins of Barclaycard

Did you know that Barclaycard was the first company in the UK to launch a credit card way back in 1966? This pioneering spirit echoes through decades, just like how The Passion Of The Christ sparked discussions on finance and forgiveness. Barclaycard’s innovative drive mirrors how technology has advanced in various sectors, from finance to HP Laptops, which have revolutionized how we manage our money on the go. With each evolution, customers find more efficient and exciting ways to spend and save.

Interesting Innovations

Barclaycard isn’t just about providing credit; it continually rolls out new features that appeal to a modern audience. For example, its contactless payment technology has changed purchase patterns globally, much like the explosive social phenomena experienced by celebrities like Sidney Summers. Customers now enjoy the freedom to make instantaneous purchases without the hassle of cash or cards, effectively blending convenience with modern living. Fun fact: Barclays also supports eco-friendly initiatives, reflecting shifts in consumer values, like the discussions around sustainable energy, seen in places like Blue California.

Financial Solutions for Everyone

Navigating financial solutions shouldn’t feel overwhelming, and that’s where Barclaycard excels. From personal loans to credit cards and rewards programs, they’ve got something for everyone. Their inclusive approach can be likened to the way individual Lashes enhance your look without overcomplicating your daily routine. Plus, they’re continually refining their mortgage loan application process to make it quicker and easier—like when you binge-watch a series such as “The War Of The Rohirrim, time flies when you’re enjoying the experience!

Imagine signing up for a Barclaycard and feeling empowered as you track your spending or earn rewards—there’s even a unique partnership with athletes like Anthony Robles, embodying success and resilience. All these innovations help people feel more confident about their finances, much like being informed about things like What are Whippets Drugs can lead to better lifestyle choices. So, whether you’re new to credit or looking to optimize your financial game, Barclaycard’s got your back!