In the world of automobile buying and selling, two words often pop up—blue book value. This phrase refers to the estimated price of a vehicle, serving as a valuable compass for both sellers and buyers. So, what exactly is blue book value? It’s typically derived from a myriad of factors including the vehicle’s make, model, age, condition, and current market tendencies. A well-recognized reference for this value is Kelley Blue Book, a platform that assesses car values based on extensive industry data and fluctuations in the economy. Knowing the blue book value helps you avoid overpayment or underpricing—nobody wants to leave money on the table!

The Importance of Blue Book Value in Car Pricing

Determining a fair price for a car can feel like a puzzle. However, blue book value simplifies the process, offering a clear framework. It serves as an industry benchmark that gives you insight into how much similar vehicles are selling for. This benchmark becomes crucial when you consider popular brands like New Balance sneakers, which also fluctuate in market value based on trends and availability. In this ever-shifting market context, knowing your vehicle’s blue book value becomes indispensable.

For sellers, accurately pricing your car can mean the difference between a sale and a lingering advertisement. Buyers, on the other hand, can confidently negotiate knowing what a fair price looks like. So whether you’re looking to sell a classic car or buy the latest model, understanding blue book value cuts through the fog, giving you clarity and confidence. When you’ve got all the facts in hand, you pave the way for smoother transactions.

Top 7 Reasons to Rely on Kelley Blue Book Value

Relying on Kelley Blue Book provides you with several compelling benefits that make it the go-to for many vehicle buyers and sellers alike. Let’s explore seven of the most crucial reasons.

1. Comprehensive Data and Research

Kelley Blue Book pulls from a vast array of data collected from dealerships, sales, and auction prices, meaning you get an accurate snapshot of current market conditions. This extensive research illustrates real-world transactions, which enhances the reliability of the blue book value.

2. Trustworthy Reputation

Founded in 1926, Kelley Blue Book has become synonymous with fair pricing in the automotive industry. Its longstanding presence has helped earn the trust of many users. When you see that blue book value, you know you’re working with a resource that both sellers and buyers respect.

3. Local Market Insights

Kelley Blue Book dives deeper than just national averages. It provides localized values that consider regional market dynamics. This nuance helps families understand pricing better based on their unique geographic location, making pricing both accurate and practical.

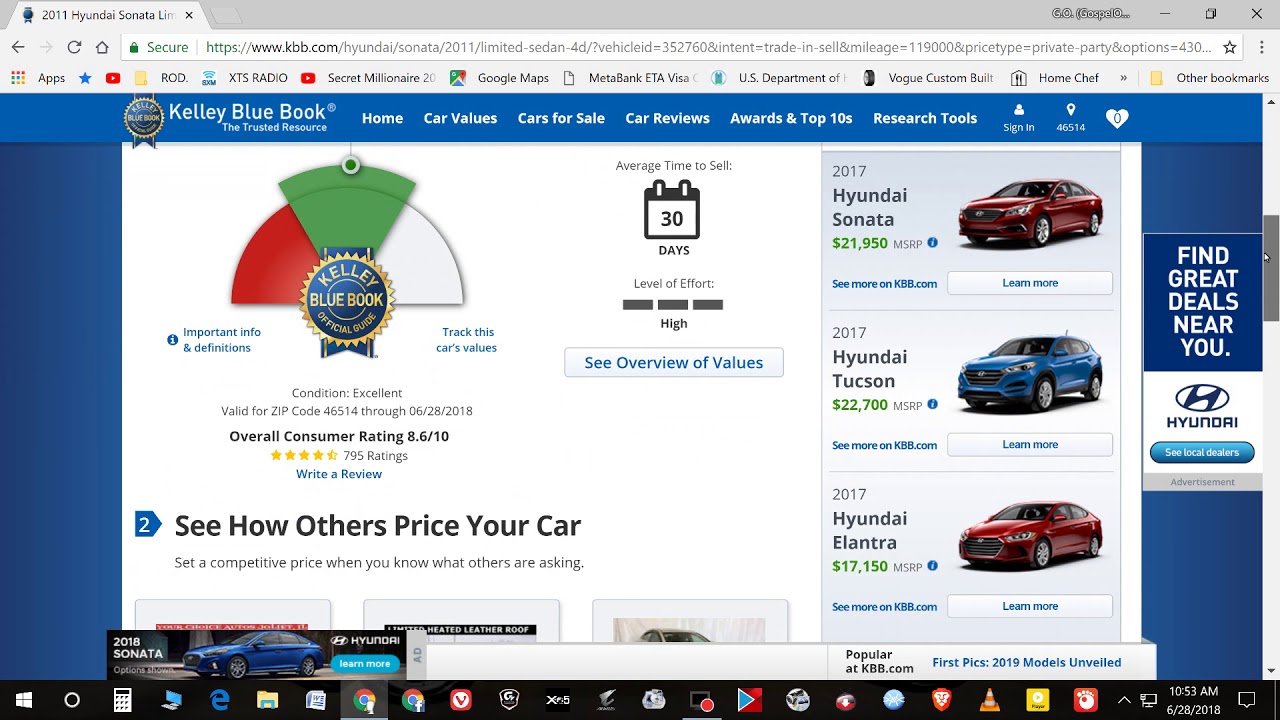

4. Easy-to-Use Online Tools

The website offers a user-friendly experience. Simply enter details like mileage and condition, and you’ll see an estimated value. With features that welcome user engagement, the tools are designed to empower you as a buyer or seller.

5. Understanding Vehicle Depreciation

Kelley Blue Book sheds light on vehicle depreciation, explaining how much value cars typically lose over time. This knowledge informs buyers about the longevity of their investments, guiding them towards more informed decisions.

6. Additional Resources

Kelley Blue Book isn’t limited to valuations. They offer expert reviews, comparisons, and even safety ratings. Such resources equip buyers with crucial information to foster smart purchasing decisions—an absolute must in today’s market.

7. Aligning with Current Market Trends

The insights provided align with market trends, enhancing transparency. This fact is especially valuable for sellers aiming to price their vehicles competitively, preventing them from relying on outdated benchmarks.

Exploring Blue Book Value: Beyond Kelley Blue Book

While Kelley Blue Book is a primary source for blue book value, there are other factors to consider when pricing cars fairly. For example, think about brand popularity or trends like Project Blue Beam, which can sway buyer sentiments. It’s fascinating to see how cultural phenomena, like the buzz around eco-friendly vehicles, can reshape price points. In such cases, relying on a singular source won’t suffice.

You might have a vehicle in a niche market, say a classic car or an electric vehicle. In that case, it’s wise to explore resources beyond Kelley Blue Book and check competitive listings to ensure you price your car effectively. Just like the varying interests in Pink Victoria’s Secret fashion trends, automobile pricing adjusts according to shifts in consumer behavior.

Navigating Car Pricing Strategies for 2026

As the automotive landscape continues to change in 2026, influenced by technology and consumer preferences, understanding blue book value becomes increasingly important. For instance, the ethos of a “Good American Family” focuses on sustainable consumption, raising interest in hybrid and electric vehicles. Sellers who grasp these trends can better position their cars in the market.

While the Kelley Blue Book value offers a solid starting point, sellers should consider additional aspects like custom modifications and service history when determining price. This well-rounded approach ensures that both buyers and sellers create fair transactions in a transparent marketplace—essential in a climate where new trends are constantly emerging.

Wrapping Up: The Future of Fair Car Pricing with Blue Book Value

Understanding blue book value is key for anyone participating in the automotive market. Armed with Kelley Blue Book insights, you can navigate pricing strategies more effectively, whether you’re selling a cherished sedan or looking for an efficient family car. As technology develops and consumer behavior shifts, having trustworthy valuation tools at your disposal will be vital.

Ultimately, whether you’re grabbing the keys to your next vehicle or bidding farewell to your trusted ride, understanding blue book value will make all the difference. With these resources, you empower yourself to achieve fair pricing and informed decisions in a rapidly changing landscape.

Understanding Blue Book Value: Fun Facts You Didn’t Know

A Peek into Car Value History

Did you know that the concept of blue book value dates back to the 1920s? It was coined by the Kelley Blue Book, which began as a simple guide for car dealerships. This blue book value has since transformed into the go-to standard for determining fair pricing in car sales. You might be surprised to learn that other industries have their own unique ‘blue book’ equivalents, such as real estate. Speaking of unique items, the Pink Victoria Secret brand has its very own line of luxurious products cherished for their quality, much like how buyers value cars based on their blue book value.

How the Blue Book Value is Determined

The blue book value isn’t just pulled out of thin air; it’s based on several factors such as vehicle age, condition, mileage, and even the current market trends. Interestingly, savvy consumers often turn to platforms like Reddit Movies to discuss their experiences and gather insights on car pricing. These discussions can help you gauge what your dream car should really cost. Just as an elite performer like Joe Klecko knows the ins and outs of football, understanding the blue book value can give you an edge in your vehicle purchase or sale.

Your Blue Book Value and You

Understanding how the blue book value works helps you become an informed buyer or seller. In fact, many buyers often overlook this crucial resource! It’s like discovering the benefits of supplements, similar to new-age products like Nugenix, that can bolster your energy levels. Knowing the blue book value empowers you to negotiate effectively, ensuring you get the best deal possible. Plus, as with finding the latest LV Slides or a top-rated vehicle, a little research goes a long way in making wise decisions—so dive into the numbers! After all, savvy decisions today can lead to a smoother ride tomorrow, whether you’re cruising in style or managing your finances with platforms like Freedom Mortgage.