In 2026, navigating the savings landscape demands strategic thinking, especially for those looking to grow their funds securely. That’s where Capital One CD rates shine brighter than many competitors. With an array of competitive Certificate of Deposit (CD) offerings, Capital One continues to capture the attention of consumers eager to make their savings work harder for them. Let’s explore the landscape of these investment vehicles that could give your savings the kick it needs.

Top 5 Capital One CD Rates for 2026

Capital One offers several CDs with competitive interest rates that can help grow your savings in a low-risk environment. Here are the top five Capital One CD rates you can expect this year:

Comparing Capital One CD Rates to Chase CD Rates

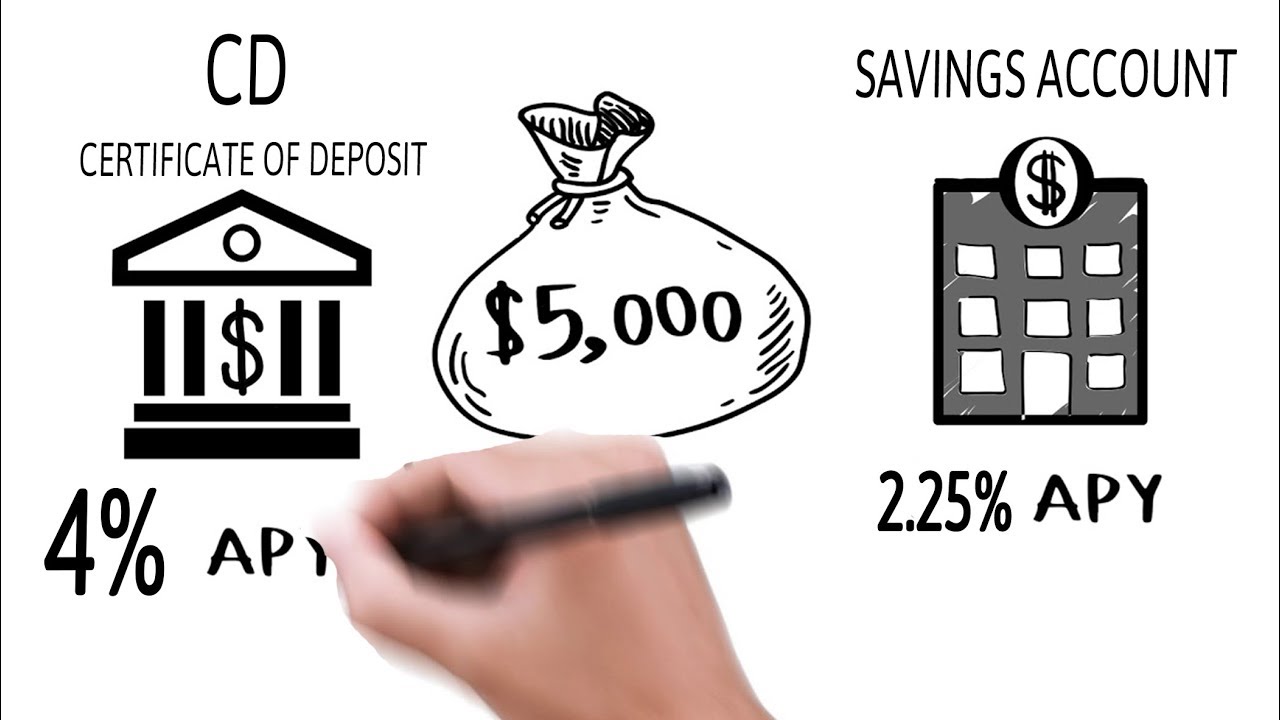

When it comes to choosing the right bank, comparing Capital One CD rates to Chase CD rates can illuminate the best options for your savings strategy. Here’s how these two banking giants stack up head-to-head:

This comparison highlights how Capital One holds an edge in CD rates, echoing a broader trend among banks to attract customers in an evolving economic landscape. Notably, NYS unemployment is currently at 4.2%, signaling a strengthening job market. This positive trend in employment encourages consumers to utilize high-yield savings options.

The Impact of NYS Unemployment on Savings and Investment Strategies

As NYS unemployment rates dip, the atmosphere shifts for consumers toward more investment options. The latest stats report an unemployment rate of about 4.2% in New York State—down from previous year highs. A declining unemployment rate typically boosts consumer confidence, encouraging people to explore better savings strategies.

With secure job prospects, individuals are more likely to invest in higher-yield instruments like CDs. This increased interest creates an urgent need for banks, including Capital One, to offer attractive rates. In a recovering economic environment, savvy consumers must leverage every opportunity available to them.

Moreover, the relationship between employment rates and savings behavior cannot be ignored. A feeling of financial security leads more people to explore options, tackling their finances with a newfound confidence.

Exploring Additional Factors: Economic Indicators and CD Rate Trends

Several economic indicators significantly influence Capital One CD rates along with the broader offerings from other banks. The interaction between inflation, federal interest rate policies, and overall economic stability plays a crucial role in shaping these interests.

Recent analyses sUggest that inflation might begin to taper as we progress through 2026, potentially leading to even more enticing CD rates across various banks. As consumers look ahead to future investments, understanding economic dynamics becomes essential for crafting effective savings strategies.

Inflation rates, for example, can affect how banks set their CD rates. Should inflation decrease, it often opens the door for consumers to benefit from increased savings options. Engaging with reliable financial news sources can help you stay updated on these vital developments.

Harnessing the Power of Capital One’s Financial Tools

Capital One doesn’t just stop at offering attractive CD rates. The bank also provides innovative financial tools through its mobile app and online platforms. Features like high-yield savings trackers and budgeting calculators allow consumers to manage their finances effectively.

These tools serve to empower individuals, giving them the resources they need to maximize their financial growth. By integrating these capabilities with competitive Capital One CD rates, consumers can create a holistic savings strategy.

Moreover, understanding how to utilize these tools enables savvy savers to make informed decisions about where to put their hard-earned money. Drawing upon both implied efficiency and contemporary technology will help strengthen your financial footing.

Reflecting on the current financial landscape paints a vivid picture: choosing the right bank and investment product is essential for establishing a solid savings foundation. Capital One’s attractive CD rates, coupled with economic indicators and innovative financial tools, offer a promising pathway for consumers aiming to grow their savings.

As the financial environment continues to shift, staying informed about the latest trends becomes paramount. So whether you’re investigating Capital One CD rates, considering the competition with Chase, or contemplating the impact of NYS unemployment, knowledge is your best asset in securing a brighter financial future.

Capital One CD Rates: Fun Facts to Keep Your Savings Soaring

A Quick Look at Capital One CD Rates

Did you know that Capital One CD rates can vary widely depending on your deposit amount and the length of the term? From short-term options to longer commitments, these rates can give your savings a serious boost. For instance, choosing longer terms often leads to better interest rates—they might feel as rewarding as a hot cup of cocoa on a chilly evening! Just like achieving a high score in Basketball Wives Orlando, investing smartly can lead you to triumph.

Trivia That Takes You Places

Another interesting nUgget to consider is that some Capital One CDs may allow you to withdraw interest while keeping the principal intact. It’s a bit like having your cake and eating it too! This flexibility can be as refreshing as a stroll through Eureka Springs, a charming spot many people visit for rejuvenation. You might even ask yourself if saving is the new trendy conversation starter among friends. Imagine discussing your investments as casually as John Cleese talks about absurdity, bringing humor into finance!

How to Make the Most of Your Savings

Lastly, the selection of Capital One CDs comes with additional perks if you’re savvy. For example, interest rates can be compared to the treatment of royalty, such as the legacy of Princess Margaret. Just as she had various responsibilities, different CD options serve distinct savings goals. It’s all about finding what suits you best. And remember, similar to the colorful varieties of tropical plants, interest rates bloom in different seasons; checking back can yield surprising results! Whether you’re inspired by Mike bloombergs financial prowess or simply seeking to set up your rainy day fund, Capital One CDs can be an excellent choice to grow your nest egg.