The Cook County Treasurer: A Catalyst for Financial Resilience and Community Support

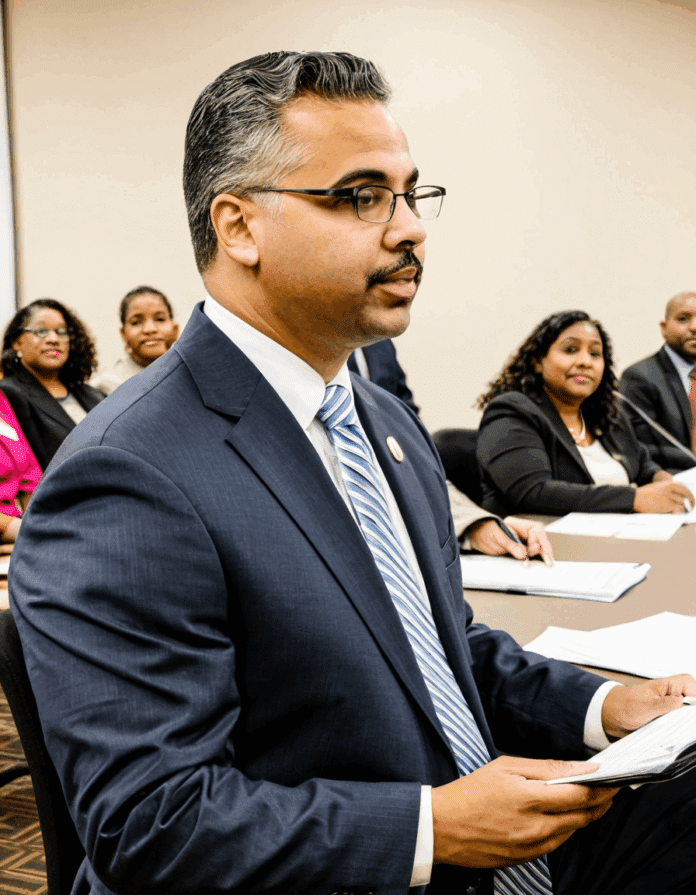

The Cook County Treasurer, a pivotal player in local governance, wields significant influence over both fiscal management and community welfare. In 2026, as the office continues to navigate financial challenges, it stands as a crucial support system for Cook County residents. With Maria Valdez at the helm, the responsibilities of the Cook County Treasurer’s office extend far beyond traditional roles. This includes collecting property taxes, overseeing public fund investments, and ensuring a culture of fiscal transparency. Valdez highlights accountability, pushing initiatives that offer vital resources to communities facing economic hurdles.

In recent years, this office played a vital role during crisis moments—especially in light of economic downturns exacerbated by events like the COVID-19 pandemic. The ever-present request for collaborative solutions reveals that the responsibilities of the Cook County Treasurer’s office are wide-ranging and demand adaptability. Key initiatives directly address the financial literacy of constituents while promoting local economic development. It’s about fostering an environment where residents not only understand their financial obligations but also feel empowered to improve their circumstances.

More than just figures and taxes, the Cook County Treasurer crafts narratives of resilience, hope, and growth. In pursuing transparency, Valdez’s office has demonstrated a commitment to meeting residents where they are, providing the tools they need to succeed, and creatively addressing challenges. When a community thrives financially, everyone benefits, thus reinforcing the importance of robust financial governance.

Top 5 Impacts of the Cook County Treasurer on Local Finance

The influence of the Cook County Treasurer resonates deeply within local communities. Here are the five key impacts that highlight this office’s role in enhancing local finance:

A. Strengthening Financial Literacy Through Community Workshops

One of the standout initiatives led by Treasurer Valdez is the introduction of financial literacy workshops. Designed to empower residents, these workshops cover essential topics such as property taxes, budgeting, and long-term investment strategies. These free sessions take place across Cook County, making them accessible to all.

Residents have lauded the workshops, making connections between financial practices and their lives. With some attendees reporting increased confidence in managing their finances, it’s evident that education has given community members the tools they need to prosper. By simplifying complex subjects, the Cook County Treasurer nurtures a financially savvy population.

B. Innovative Use of Technology in Service Delivery

Technology has reshaped how the Cook County Treasurer’s office operates. By implementing an online payment portal for property taxes, the office has not only enhanced convenience but also addressed rising demands for efficient service delivery. The integrated feature for USPS mail forwarding adds another layer of accessibility, ensuring residents can stay updated even if they move around.

This innovation means residents no longer face long lines or missed payments. Despite challenges posed by the digital divide, the Cook County Treasurer remains committed to finding solutions. Ongoing improvements to digital tools can serve as a pathway to greater financial engagement among residents, enhancing the overall experience of dealing with local finances.

C. Partnership with Local Organizations for Economic Development

Collaboration with local nonprofits and businesses is another hallmark of the Cook County Treasurer’s influence. Partnerships, such as those with the Chicago Community Loan Fund, have targeted resources toward minority-owned small businesses that are often overlooked. By offering funding and support, these initiatives stimulate job creation and invigorate local economies.

Recent reports have shown that these partnerships can lead to sustainable growth in struggling areas of Cook County. When local economies flourish, residents experience improved living conditions and a stronger sense of community. These partnerships are about planting seeds for future growth.

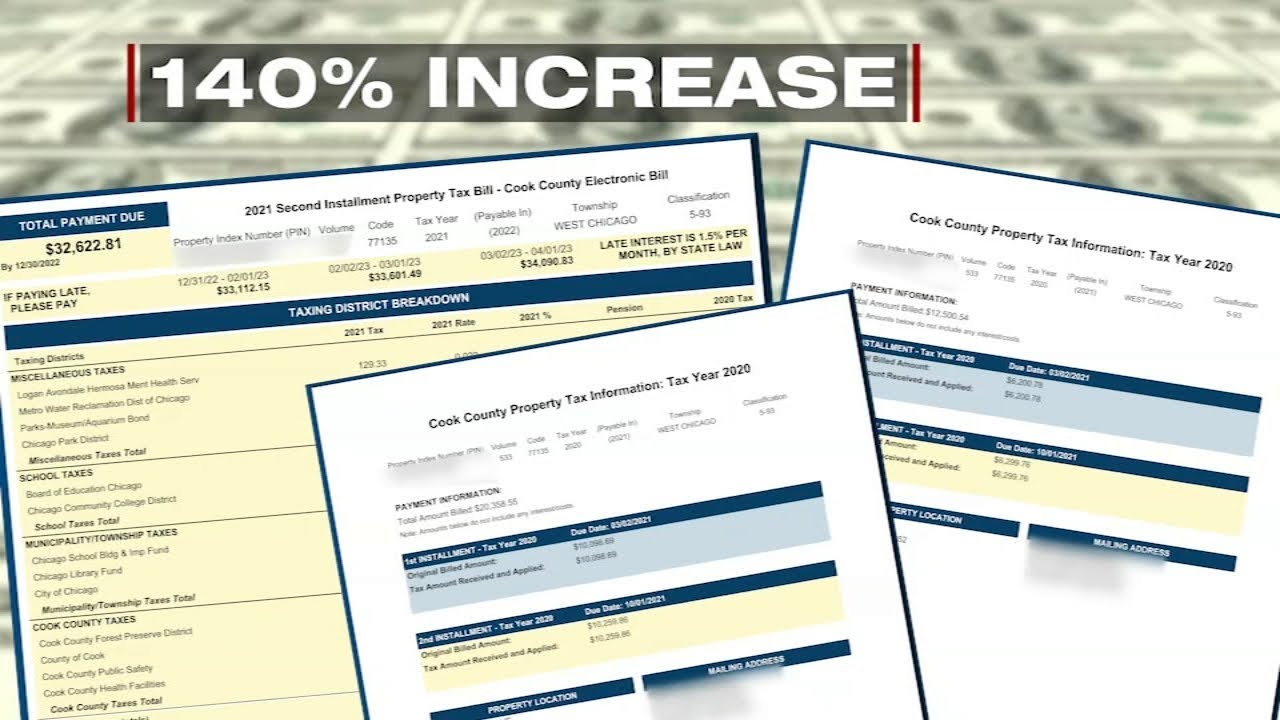

D. Temporary Relief Programs Amid Economic Challenges

In response to the unpredictable economic landscape, the Cook County Treasurer’s office has implemented several temporary relief programs. These include extending deadlines on property tax payments and providing financial assistance to low-income families during crises. Particularly following the pandemic, these initiatives have showcased the Treasurer’s dedication to community welfare.

Many families have benefited from such timely support, allowing them to chart a more stable financial course. Relief programs reflect a crucial understanding that economic health directly influences social well-being. As challenges emerge, the Treasurer actively seeks ways to alleviate burdens on local families.

E. Advocating for Sustainable Investments

Investment strategies within the Cook County Treasurer’s office are placing a growing emphasis on sustainability. Fund allocations now prioritize environmentally friendly projects, focusing on green infrastructure initiatives that promise long-term financial and ecological returns. This shift showcases a progressive rethinking of investment strategies.

By championing sustainable investments, the office promotes community health while asserting that fiscal responsibility can go hand-in-hand with environmental stewardship. Policies that intertwine economic vitality and ecological care set the stage for a more resilient future.

The Role of Communication: Engaging the Community

Effective communication forms the backbone of community engagement in the Cook County Treasurer’s office. Regular newsletters, social media updates, and accessible online resources keep residents informed about financial matters and policy changes. This strategy fosters trust between the constituents and their government.

Transparent communication ensures that residents feel heard and considered. When people understand how their taxes work, they are likely to be more engaged in local governance. The educational approach implemented by Valdez’s office reflects a commitment to building a stable community where financial literacy is valued.

Challenges Facing the Cook County Treasurer

Despite notable successes, the Cook County Treasurer’s office has encountered significant hurdles. Budget constraints pose ongoing challenges to initiatives aimed at improving community outreach and support. Particularly in times of economic uncertainty, ensuring equitable access to resources becomes increasingly complicated.

Another pressing challenge relates to the digital divide. Not every resident has reliable internet access or the ability to navigate technological tools. This discrepancy can significantly affect participation in workshops and access to online services, making it essential for the Treasurer’s office to find inclusive solutions for all.

The Future: Vision and Initiatives Ahead

Looking ahead, the Cook County Treasurer firmly aims to increase its outreach initiatives. Proposed partnerships with local schools highlight a vision focused on providing financial education earlier in students’ academic journeys. By equipping the next generation with critical financial knowledge, the office hopes to build a more financially literate community for years to come.

Ultimately, these goals align with long-term sustainability, matching ambitions with capability. Bolstered by a belief in community empowerment, the Treasurer envisions enriching Cook County through educational initiatives and investment strategies. A successful Cook County Treasurer not only uplifts local economies but also secures a brighter future for all residents, making ongoing adaptation essential.

As the Cook County Treasurer continues to prioritize fiscal responsibility alongside community welfare, the impacts of these initiatives will undoubtedly shape the community’s future. With transparent leadership and innovative programs, Cook County is well-equipped to meet the financial challenges of tomorrow, ensuring that no resident is left behind.

The Cook County Treasurer: Fun Trivia and Interesting Facts

Financial Foundations and Fun Facts

When we think about the responsibilities of the Cook County Treasurer, it’s easy to get lost in the intricacies of tax collection and investment management. However, this role has roots that stretch back through Chicago’s vibrant history. Did you know that Cook County is home to over 5 million people? That’s a diverse community with different needs and priorities, which makes the job of the Cook County Treasurer not just crucial, but also dynamic. This office plays a pivotal role in deciding how funds are allocated, very much like the way a coach strategizes before a game—think of those thrilling Philadelphia Eagles Vs Kansas city chiefs match player Stats!

Community Impact

Not just about numbers and finances, the Cook County Treasurer also promotes community engagement by initiating programs that assist residents. For example, local initiatives, similar to a simple yet fun kid’s trampoline, can offer a safe space for community activities while teaching financial literacy. Exciting programs can empower citizens to manage their finances and invest wisely—skills that stick with them for a lifetime. Speaking of investment, the Treasurer’s office actively seeks to maximize revenue from tax dollars collected, ensuring that funds go back into the community for resources such as schools, parks, and public services.

Trivia That Connects

And here’s a fun tidbit: the Cook County Treasurer’s office once introduced a digital platform to streamline tax payments, much like how tech evolves in our personal lives—hello, Kindle Store! This move towards modernization reflects not just a necessity but a desire to enhance user experience. Moreover, let’s not forget faces like Cara Mia Wayans, who remind us that just as public figures can positively influence community spirit, the dedication of the Cook County Treasurer reshapes the financial well-being of its residents.

So, next time you hear about the Cook County Treasurer, remember it’s not only about crunching numbers. This office is a vital part of community life, blending financial responsibility with the everyday joys and challenges that residents face—much like how we all follow news stories, from the curious case of the Lindbergh baby to the latest updates on sports, like the exciting Owala 40 Oz water bottles flying off the shelves in the sporting goods sections. Navigating the fiscal landscape can be challenging, but the Cook County Treasurer makes it an adventure worth exploring!

At what age do you stop paying property taxes in Illinois?

In Illinois, there’s no specific age when you stop paying property taxes, but seniors may qualify for exemptions that can help reduce their tax burden.

Did not receive Cook County property tax bill?

If you didn’t receive your Cook County property tax bill, it’s a good idea to check with the Cook County Treasurer’s office. They can help you find out what’s going on and provide a duplicate bill if needed.

What is the senior freeze exemption in Illinois?

The senior freeze exemption in Illinois helps eligible seniors keep their property tax bill from rising. It freezes the assessed value of their property, which can lead to significant savings.

What date are property taxes due in Illinois?

Property taxes in Illinois are generally due on the first business day of March and the first business day of September each year.

Do property taxes go down after age 65?

Property taxes don’t automatically go down just because you turn 65, but there are exemptions available that can lower your tax bill if you’re a senior.

Do senior citizens pay taxes in Illinois?

Yes, senior citizens do pay property taxes in Illinois unless they qualify for certain exemptions that can make them eligible for reductions.

Why are Cook County tax bills delayed?

Cook County tax bills might be delayed due to various reasons like budget issues, changes in assessment values, or delays in processing from local governments.

What is the homeowners exemption in Cook County property tax?

The homeowners exemption in Cook County reduces the taxable value of a primary residence, leading to lower property taxes for qualifying homeowners.

How long can you go without paying your property taxes in Illinois?

In Illinois, if you fail to pay your property taxes, you can usually stay in the property for two years before the county can take action to sell it for unpaid taxes.

Do you have to apply for senior exemption every year in Cook County?

In Cook County, you do need to apply for the senior exemption every year to maintain eligibility, though there are some exceptions that might apply.

What state has no property tax?

No state in the U.S. has completely no property tax, but some states do have very low property tax rates or offer alternative forms of taxation.

What is a $12000 property tax exemption?

A $12,000 property tax exemption means that your property’s assessed value is reduced by that amount when calculating your taxes, lowering your overall bill.

Will Cook County property tax bills be mailed?

Yes, Cook County property tax bills will be mailed out, usually to the address on record for the property.

What year to deduct property taxes?

You can deduct property taxes for the year they were paid, which typically means using them on your tax return for the year you received the bill and made payment.

How do I find my Illinois property tax bill?

To find your Illinois property tax bill, you can visit the Cook County Treasurer’s website and enter your property details to access your bill online.

Who is exempt from paying property taxes in Illinois?

Generally, veterans, some seniors, and individuals with disabilities may be exempt from paying property taxes in Illinois, depending on specific criteria.

At what age do you get exempt from property taxes?

In Illinois, there’s no absolute age at which you get exempt from property taxes, but certain exemptions are available to seniors starting at age 65.