In 2026, the electrification of transportation continues to gain momentum, and this demand is significantly impacting the performance of various companies involved in the electric vehicle (EV) ecosystem. One such company experiencing a notable rise is EnviroX (envx). This article explores why envx stock is surging and examines the broader implications for the electric vehicle market and related stocks.

5 Factors Contributing to envx Stock’s Remarkable Performance

1. Rising EV Adoption Rates

The increasing demand for electric vehicles globally has kicked traditional automotive manufacturers into high gear. With environmental concerns at the forefront of consumer preferences and government incentives driving sales, major players like Tesla and Rivian are basking in the limelight. EnviroX, a company specializing in crucial components for EVs, has creatively capitalized on this trend. In fact, reports indicate that electric vehicle sales have tripled since 2021, directly benefiting firms like EnviroX and boosting envx stock! It’s no wonder that more investors are directing their attention towards stocks in this booming industry.

2. Strategic Partnerships with Major Manufacturers

EnviroX has recently secured an exciting partnership with automotive giant Ford, providing lithium-ion batteries for its new line of electric trucks. This alliance has not only ramped up investor confidence but also sharpened revenue forecasts for the future. Similar partnerships have worked wonders for other companies in the sector. For instance, NIO and Lucid Motors Lcid stock) have also seen their stocks rise as they enable innovative electric technologies. With collaborations like these, companies set the stage for a competitive advantage, nurturing a burgeoning environment that encourages growth.

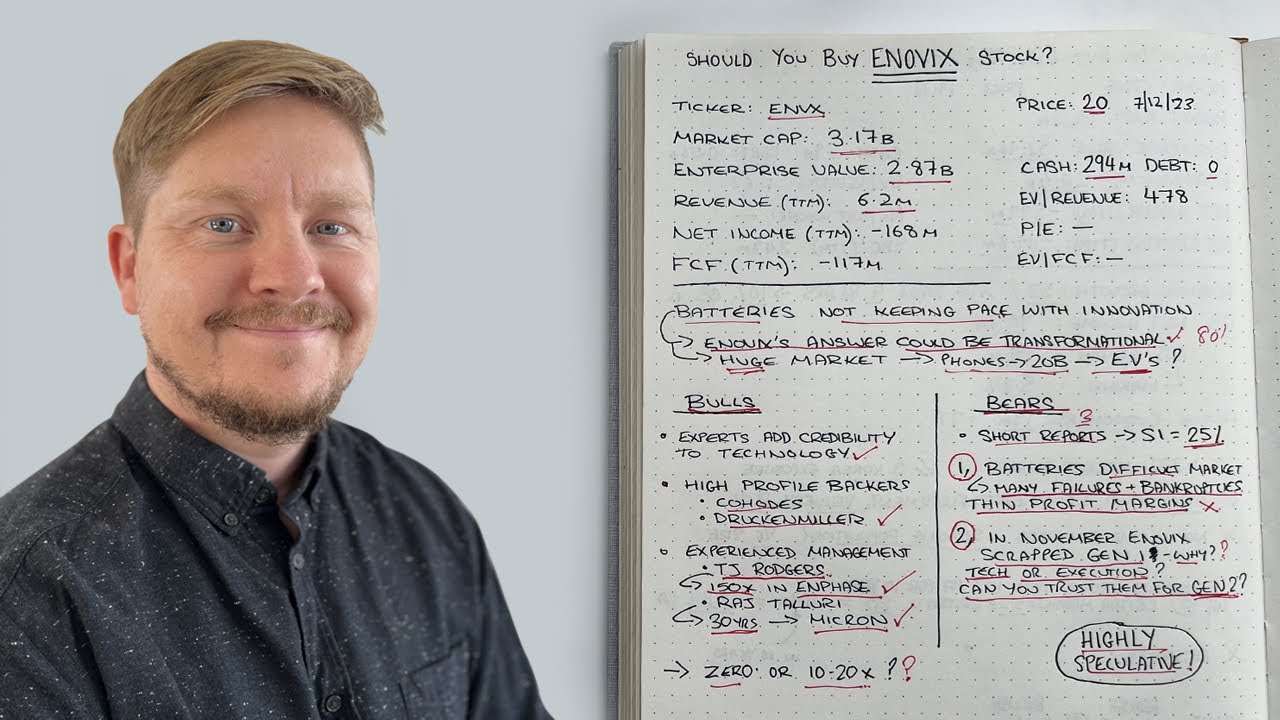

3. Technological Advancements in Battery Efficiency

The electric vehicle market constantly benefits from ongoing innovations in battery technology, including advancements from renowned developers like QuantumScape. These innovations have significantly improved battery efficiency and lowered costs. Companies like EnviroX, which are heavily invested in research and development, attract a lot of investor attention. Even competitor stocks, like TNXP stock, find it challenging to compete in an arena revolutionized by efficient battery solutions. It’s clear that when it comes to the future of electric mobility, companies that innovate will thrive.

4. Government Initiatives and Funding

Various governments worldwide are increasingly pouring funds into electrification initiatives. For instance, the Biden administration’s infrastructure bill allocates significant resources to boost EV adoption within the U.S. Such extensive governmental support is a game-changer, propelling envx stock higher while aligning with broader economic growth trends. Similar moves can be seen in tech firms like ORCL stock, reflecting a shift towards supporting green initiatives as the environmentally conscious sentiment gains traction among consumers.

5. Market Sentiment and Investor Interest

The buzz around the electric vehicle sector has led to a ripple effect across the stock market. Investors find themselves shifting gears towards renewable energy and electric mobility, fueling increasing demand for firms like EnviroX. Stocks such as NVO stock and FFIE stock, which focus on sustainable solutions, are also painting a bright picture. This heightened market enthusiasm is not just about profits; it’s also about a vision of a greener, more sustainable future, making EV companies a hot topic among investors keen on emerging trends.

Comparative Stock Performance: envx vs. Industry Peers

While envx stock has seen immense growth, it’s important to consider how it stacks against other stocks in the EV and renewable sectors.

Innovative Future: What’s Ahead for envx Stock and Electric Vehicles?

With the projected acceleration of electric vehicle sales continuing through 2030, the implications are extensive. EnviroX isn’t merely riding this trend; it’s at the center of a sustainable shift capable of redefining transportation.

Emerging technologies like autonomous driving and smart car integrations add further layers to this equation. Companies such as EnviroX are not only anticipating gains from this transition but are also leveraging their innovative spirit to expand their offerings. As they embrace these technological advancements, related sectors—including battery production and software integration—are likely to experience a transformative future.

The rise of envx stock, fueled by phenomenal industry growth and strategic business decisions, suggests a substantial shift towards an electric future. This isn’t just a temporary rally—it reflects a foundational change in how transportation, technology, and environmental stewardship can come together. Investing in areas around electric vehicles may yield financial returns, but it can also contribute to building a sustainable world for future generations. The unique opportunity to be part of this innovative wave is here, and it’s energizing stock markets the world over.

In Conclusion

As EnviroX continues to experience a meteoric rise amid surging electric vehicle demand, its story serves as a cautionary tale for those still invested in traditional industries. With the right partnerships, technological advancements, and a supportive government framework, envx stock represents more than just a financial asset; it stands as a beacon for a future where sustainable transportation can thrive. The marketplace is evolving, and those who recognize the significance of electrification will undoubtedly reap the benefits in the coming years.

envx stock: Fun Trivia and Interesting Facts

Shocking Surge in Green Energy

Did you know that electric vehicles (EVs) are projected to take over more than 30% of the global automobile market by 2030? With the increasing demand for clean transportation, the spotlight’s shining brighter on companies like those tied to envx stock. The rapid ascent is reminiscent of the excitement surrounding nvdl stock, marking a shift in how consumers approach mobility. Amid this evolution, it’s refreshing to see traditional automakers also catching on, bringing innovative models like the 2017 Toyota Tacoma into play to support a more sustainable future.

Celebrities and the EV Buzz

In pop culture, electric vehicles aren’t just a trend; they’re a conversation starter. Stars like Vincent Herbert and shows like “Love is Blind” are embracing this shift, showcasing eco-friendliness in their brands. The star-studded world of glam and cars shows how envx stock is becoming a household name. Surprisingly, many leading fashion houses, including Yves Saint Laurent, are also exploring sustainable practices, resonating with what modern consumers want—style with a conscience.

Weathering Change

Weather changes can significantly impact production and sales in industries including automotive. Imagine navigating through harsh Texas weather or the occasional downpour in Vancouver weather that could affect deliveries. Similarly, stocks react to environmental factors, making the performance of envx stock not only dependent on demand but also on climatic conditions. Keeping track of trends and stocks isn’t just for Wall Street; it’s becoming essential for everyday investors as they look to the future.

As electric vehicles and sustainable practices gain traction, it’s clear that the world of investing is adapting. With envx stock buzzing in correspondence with rising consumer interest, this fascinating blend of technology, celebrity, and environmental consciousness marks an exhilarating time for investors.