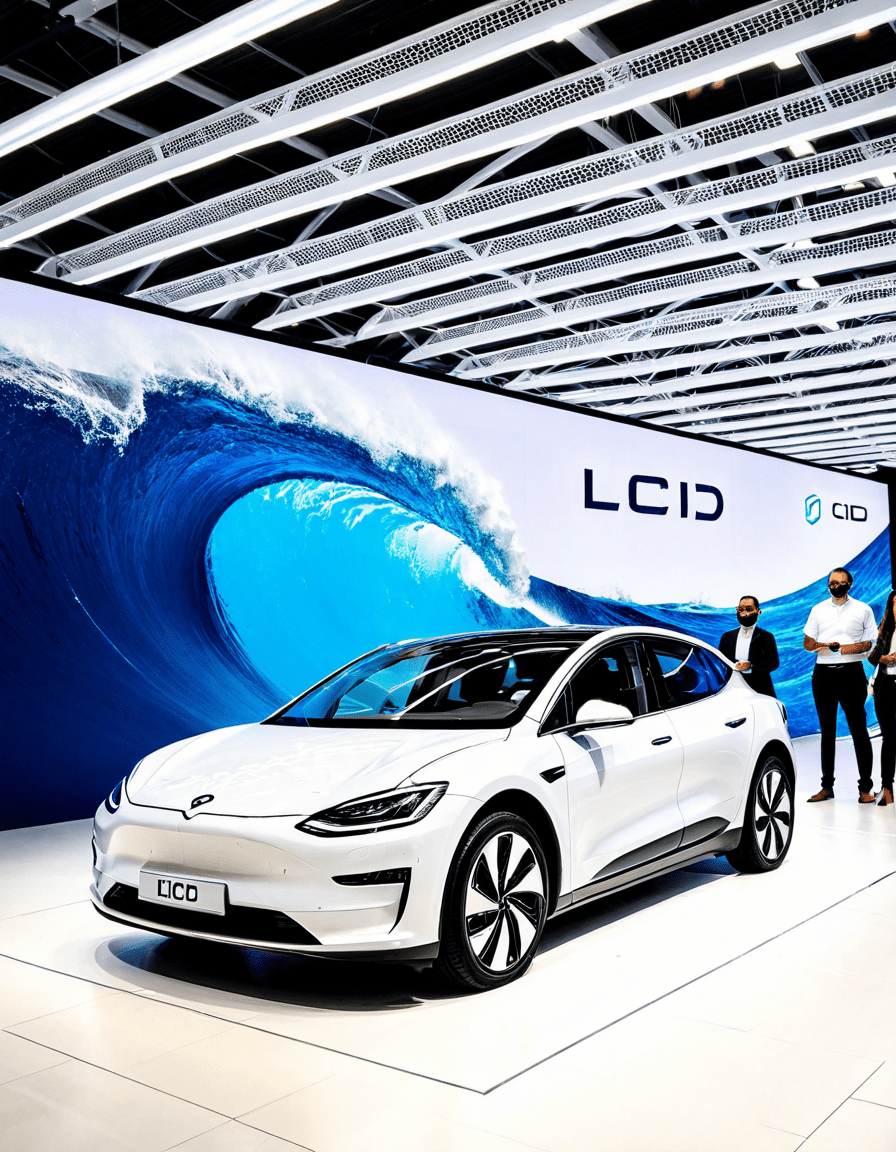

As the electric vehicle (EV) market experiences explosive growth, lcid stock—representing Lucid Motors—is increasingly becoming a focal point for investors looking for the next big breakthrough. With the landscape projected for 2026 seeing various competitors, advancements in technology, and shifts in consumer behavior, investors must understand how lcid stock might evolve. This journey has profound implications for both the company itself and the broader automotive industry.

Key Factors Driving lcid Stock Performance in 2026

The performance of lcid stock in 2026 will hinge on several pivotal factors that investors need to consider:

Top 5 Electric Vehicle Trends Influencing Lucid Motors and lcid Stock

Examining currently unfolding trends relevant to lcid stock reveals significant implications for the future:

Comparing lcid Stock with Major Competitors

To gain a clearer picture, it’s crucial to weigh lcid stock against major competitors like Tesla, Rivian, and Ford Electric Vehicles:

Analysts’ Predictions for lcid Stock in 2027

Looking ahead to 2027, analysts present a mixed bag of predictions regarding lcid stock, emphasizing the necessity for ongoing innovation and responsiveness to shifting market conditions:

In conclusion, Lucid Motors stands at a crucial point in 2026, amidst a rapidly changing landscape in the EV industry. The interplay of technological advancements, regulatory policy, and competitive actions will inevitably shape the trajectory of lcid stock in the coming years. This narrative extends beyond the ambitions of one company, connecting to a transformative movement occurring in the automotive sector. As Lucid maneuvers through these developments, the ongoing story promises to capture the attention of investors and consumers alike, marking a potentially exhilarating time in electric vehicle history.

LCID Stock: Fun Trivia and Intriguing Facts

Shocking Milestones and Electric Dreams

Did you know that LCID stock is becoming quite the conversation starter in the electric vehicle (EV) sector? Founded by a group of tech-savvy innovators, Lucid Motors has made headlines with its stunning luxury models. In 2021, the company celebrated its first EV delivery, which was met with a buzz worthy of mention alongside other hot stocks like Nvdl stock. Lucid’s impressive range—the Lucid Air—boasts a staggering 517 miles on a single charge, setting the bar high in a market dominated by competitors. Now, that’s something to rev your engines about!

Speaking of impressive offerings, the leading names in the EV industry often look towards tech hubs for inspiration. The culture in places like Austin, Texas adds an electric zest to innovation, especially with the city’s sunny Texas weather, making it a hotspot for startups. It’s no surprise that investors are eyeing LCID stock closely as Lucid looks to expand its reach. Beyond cars, they’re also collaborating in new energy solutions, keeping the buzz alive and well in conversations about electric trends.

Behind the Scenes: Fun Insights

Investors often hunt for the next big thing, and LCID stock sure fits the bill. In late 2021, Lucid raised a whopping $4.5 billion through SPAC mergers, leading to chatter akin to the latest blockbusters reminiscent of the tale of Boku no Hero Vigilante. While Lucid focuses on luxury and performance, they aren’t shy about celebrating unique elements like the interior crafting materials, which make the driving experience feel truly bespoke. It’s similar to how the Beach Club scene blends relaxation with flair—everyone wants that perfect experience!

The collective excitement doesn’t stop there. Analysts have drawn comparisons between emerging players, peeking at the potential of EV technology and innovations set to disrupt traditional market patterns, much like how ENVX stock is capturing attention with its focus on battery advancements. With key figures like Nicholas Crovetti capturing the essence of youth in the EV revolution, it becomes evident that Lucid is not just building cars; it’s cultivating a lifestyle. And as investors navigate the fast lane of EV stocks, it could prove beneficial to keep an eye on the path ahead, all while riding the wave of hype surrounding the burgeoning industry.

Is Lucid a buy or sell?

Whether Lucid is a buy or sell really depends on your investment strategy and risk tolerance. Some investors see potential in its luxury electric vehicles, while others are cautious due to financial challenges and competition.

Is Lucid doing a reverse split?

Lucid hasn’t announced any plans for a reverse split, so for now, it looks like they’re focused on growing their business and production capabilities rather than restructuring their shares.

Is there a future for LCID?

There is still a future for LCID, but it hinges on how well the company can execute its production goals and compete in the market. Analysts keep a close eye on their strategies, but time will tell how it plays out.

Is Lucid the next Tesla?

While some fans hope Lucid could be the next Tesla, it faces steep competition and has to prove itself in the electric vehicle space. The success of its luxury model lineup will be key to its reputation and growth.

What are the best AI stocks to buy today?

As for the best AI stocks today, companies like Nvidia, Alphabet, and Microsoft are often highlighted due to their strong positions in AI tech. Researching these stocks further or consulting a financial advisor can help you decide.

Is Lucid being bought out?

Lucid has not publicly confirmed any buyout offers or talks, so it remains an independent company as of now.

Can you lose stock in a reverse split?

In a reverse split, you won’t actually lose stock in the sense of having zero shares, but your total number of shares will decrease while the value of each share increases proportionately, so it’s more about how your stake is valued rather than losing stock.

Is Lucid merging?

There’s no news about Lucid merging with another company right now. Their focus seems to be on expanding their own operations rather than seeking a merger.

Is Lucid Motors laying off?

Reports have indicated that Lucid Motors has laid off employees as part of cost-cutting measures. This reflects their need to manage expenses as they work on ramping up production.

What will Lucid be worth in 2030?

Predicting Lucid’s worth in 2030 is tricky, as it depends on several factors like market conditions, technological advancements, and company performance. Keep an eye on their growth and strategies for better insights.

Who owns the most LCID stock?

As of now, the largest shareholder of LCID stock is its CEO, Peter Rawlinson, among other institutional investors. This often indicates confidence in the company’s future.

What is the best stock to invest today?

Choosing the best stock to invest in today depends on your goals and risk profile. Consider looking at companies with strong fundamentals and growth potential to find what suits you best.

Is Lucid the next Fisker?

Lucid and Fisker have different focuses, but if one is looking for comparisons, it’s tough to say Lucid will follow Fisker’s path or vice versa. Both face unique challenges and opportunities in the EV market.

How many cars will Lucid sell in 2025?

Estimating how many cars Lucid will sell in 2025 is speculative. However, they aim for significant growth if production ramps up and demand meets expectations.

Will Lucid stock ever recover?

Lucid stock recovery will depend on various factors like market trends, company performance, and broader economic conditions. Investors will have to watch how they progress over time.