In recent years, the insurance industry has undergone a remarkable transformation, with innovative startups like Lemonade Insurance leading the charge. As a company that blends technology with a strong social mission, Lemonade is reshaping how we perceive and purchase coverage. Its tech-driven approach not only simplifies complex insurance processes but also addresses consumers’ evolving needs. This article explores the various facets of Lemonade Insurance, highlighting its unique features and the ripple effects it’s creating across the traditional insurance landscape.

7 Key Ways Lemonade Insurance Is Changing the Game

Lemonade Insurance has redefined how customers view pricing. With a flat fee structure, they charge a straightforward premium and promise to handle claims both fairly and efficiently. Unlike many traditional insurance companies that shroud fees in fine print, Lemonade’s clarity ensures customers know precisely what they’re paying for. For example, their monthly renters insurance starts at an exceptionally low rate of just $5, allowing younger individuals and small families to gain essential coverage without breaking the bank.

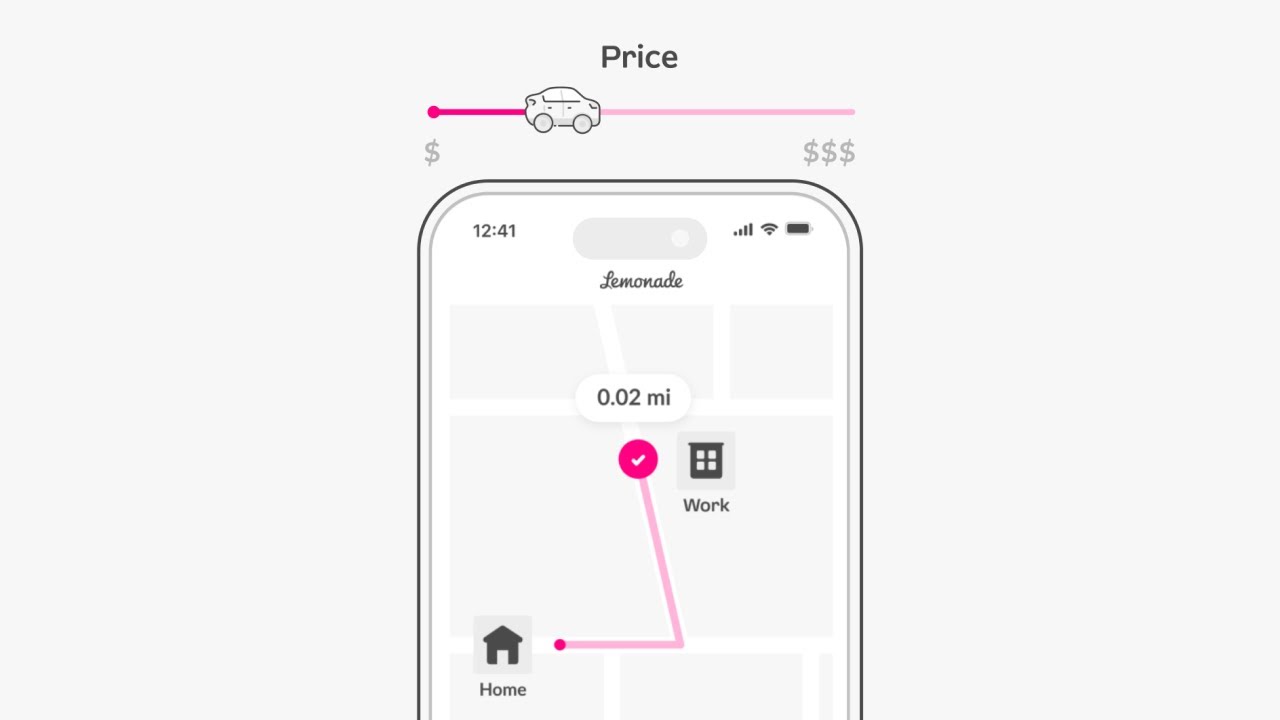

In today’s fast-paced world, speed matters, and Lemonade answers that call through artificial intelligence. Their app allows users to submit claims that, thanks to AI technology, can be evaluated and approved in mere seconds. One standout case involved a customer who faced significant water damage; they were thrilled to have their claim resolved within just three minutes of filing. This stands in stark contrast to the often frustrating waiting times associated with traditional insurers, which can stretch on for weeks or even months.

Beyond just profits, Lemonade incorporates a refreshing ethos into their operations. Their innovative “Giveback” feature means that unclaimed premiums are redirected to charities chosen by policyholders themselves. This unique model not only encourages users to make fewer claims but also fosters a sense of community. In 2025 alone, Lemonade donated over $2 million to various noble causes, demonstrating how consumer choices can directly fuel social impact.

Lemonade has rapidly expanded into pet insurance, catering to the needs of pet owners looking for comprehensive yet straightforward coverage. Their Lemonade Pet Insurance covers both accidents and illnesses while ensuring the claim process is user-friendly and quick. Pet owners rave about customizable plans tailored to the needs of different pets. In fact, many have touted the supportive claims process as one of the main reasons for choosing Lemonade over more traditional options.

The Lemonade mobile app stands out not just for its functionality but also for its intuitive design. Users can easily manage their accounts, submit claims, and access assistance—all within a few taps. A particularly engaging feature is Maya, a chatbot that helps guide users through various processes, creating a personalized and engaging experience. Recent surveys show that a whopping 80% of users are satisfied with the app’s interface and ease of use, reflecting Lemonade’s commitment to customer experience.

Obtaining insurance doesn’t have to be a drawn-out affair, and Lemonade proves it. Users can often get renters insurance within minutes, eliminating the lengthy application processes commonly associated with traditional firms. Take, for example, a New York student who secured renters insurance on moving day. This timely responsiveness mitigated last-minute anxieties during an already hectic period in their life.

With a keen eye on emerging trends, Lemonade continually explores new niche coverages, such as those for e-sports and digital assets. This adaptability caters particularly to tech-savvy millennials and Gen Z consumers, propelling the company to the forefront of insurtech innovations. As lifestyles evolve, so does Lemonade Insurance, ensuring it aligns with the dynamic needs of modern consumers.

Why Lemonade’s Model Threatens Traditional Insurers

The impact of Lemonade on the insurance sector is hard to ignore. Their rapid growth has created undeniable pressure on established giants like State Farm and Allstate. This nimbleness in leveraging technology to improve user experience has compelled traditional insurers to rethink their strategies. Slowly, but surely, they’re adopting similar features to stay relevant, indicating a notable shift toward technology-based solutions.

The mission-driven approach of Lemonade resonates particularly with the younger generations, who are drawn to brands demonstrating social responsibility. This crucial pivot creates significant challenges for conventional insurers, which have long been viewed as profit-centric entities lacking a social conscience. As consumers increasingly prioritize ethical practices, traditional insurers must adapt or risk losing ground.

The Future of Insurance: Lessons from Lemonade

As we step further into 2026, it’s increasingly clear that Lemonade Insurance is pioneering a new era. This shift is characterized by an emphasis on personalization, efficiency, and social responsibility. The industry is moving away from the bureaucratic norms that have long defined it. Lemonade’s tech-forward and customer-centric practices set a precedent that many traditional companies are striving to replicate.

To survive in this new landscape, conventional insurers need to embrace change. They must blend profitability with purpose, ensuring that coverage remains accessible and transparent. As competitors strive to adapt, the legacy of Lemonade Insurance will undoubtedly influence future generations of policyholders who expect a lot more than simple protection from their insurance providers. From understanding customer needs to fostering community spirit, these lessons highlight the paramount importance of innovation in shaping the future of this essential industry.

In closing, Lemonade Insurance stands at the forefront of a paradigm shift in the insurance industry, and as we continue to witness these updated models, one question remains: how will traditional insurers respond in kind? Adaptation is no longer optional; it’s essential for survival in this fast-evolving landscape.

How Lemonade Insurance is Refreshing the Coverage Game

A Fresh Take on Insurance

Lemonade insurance is all about shaking up the traditional insurance model. Founded in 2015, this insurance company flips the script on how policyholders interact with their coverage. Instead of the usual corporate feel, Lemonade focuses on transparency and social good, using a unique model that allows for charitable donations from unclaimed funds. If you’re curious about how innovative companies operate in our daily lives, you might want to check out Washington Post Games, which engage readers in fun, interactive ways. Just like those games, Lemonade’s approach aims to keep consumers playing a more active role.

Celebrities and Lemonade

Interestingly, Lemonade insurance isn’t just changing the insurance landscape; it’s caught the attention of pop culture too. Rami Malek, known for his various roles in films and TV shows, celebrates this fresh approach to insurance in his own way. His unique style reminds us that innovation can come from anywhere. On a related note, looking at the world of entertainment, individuals like Scott Eastwood are also influencing how brands market to younger audiences, bridging the gap between traditional products and modern demands.

Trivia and Tech

Did you know that Lemonade utilizes artificial intelligence to handle claims? This tech-savvy approach is a big change from traditional insurance methods, allowing for quicker processing times. Speaking of innovations, the famed Spanish fountain, Fuente de la Cibeles, has become a landmark, just like Lemonade has become iconic in insurance. They both signify a shift towards greater engagement, and if that doesn’t make you think, then maybe exploring The fear Of Crowds and how it affects social interactions—like the insights shared in “the fear of crowds” article—might just interest you.

With all this exciting change, consumers can feel empowered to choose coverage that reflects their values and lifestyles. As Lemonade insurance continues to transform the industry, it’s a fascinating time to be involved in anything from insurance to sports like the classic Barcelona Real madrid rivalry. Innovation is everywhere, and navigating it can lead to incredible discoveries, making the mundane—like insurance—a bit more exciting!