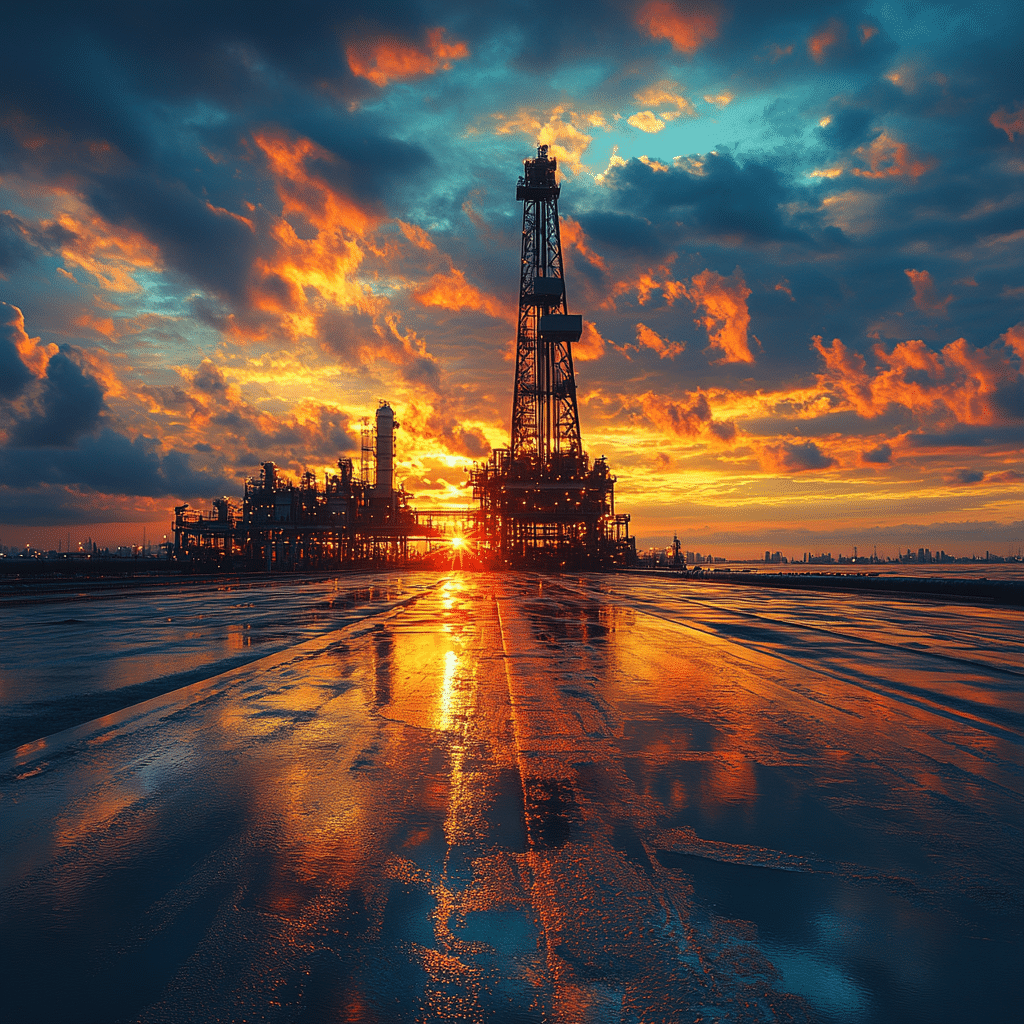

The role of a mutual fund in energy is changing fast in today’s economy, especially in sectors that focus on sustainable development. In an era where climate change and environmental threats loom large, investments aren’t just about turning a profit; they now carry a weighty responsibility towards fostering a greener future. Investors are increasingly seeking opportunities that not only promise financial returns but also contribute positively to the health of our planet, particularly through innovative approaches in renewable energy. Let’s take a deeper dive into how some mutual funds are leading the charge in sustainable energy and the partnerships making it all possible.

Top 5 Mutual Funds in Energy Driving Sustainable Change in 2024

1. Vanguard Energy Fund (VGENX)

Vanguard’s Energy Fund is a front-runner in renewable investments, especially focusing on solar and wind energy. With a strategic emphasis on companies that innovate in green tech, Vanguard is not just expanding its portfolio but also reinforcing its commitment to sustainable practices. Their collaboration with energy partners across the nation has made them iconic in integrating sustainability into mainstream investing.

2. iShares Global Clean Energy ETF (ICLN)

Diversity is the name of the game with the iShares Global Clean Energy ETF. This fund boasts a portfolio that prioritizes firms dedicated to wind, solar, and alternative energy solutions. If you’re an investor who’s passionate about eco-friendly developments, ICLN is a fantastic place to park your money. Their relationship with climate education organizations reflects their dedication to furthering sustainable practices.

3. American Funds New Perspective Fund (ANWPX)

American Funds’ New Perspective Fund takes a broader view by diversifying investments while focusing heavily on energy efficiency technologies. Companies like Tesla and others in electric vehicles (EV) perfectly illustrate how this fund supports innovation and sustainable growth. Also noteworthy is their synergy with firms such as Acceptance Insurance, which emphasizes energy-efficient practices in their operations.

4. T. Rowe Price Global Technology Fund (PRGTX)

Technology plays a significant role in the shift toward a sustainable energy future, and T. Rowe Price is leading that charge. This fund invests in tech-focused companies that offer breakthrough solutions like smart grid technology, which advances energy conservation. Partnerships with community healthcare networks are also worth mentioning, emphasizing a holistic approach to energy efficiency.

5. Fidelity Select Utilities Portfolio (FSUTX)

For those keen on utility companies pivoting towards renewables, the Fidelity Select Utilities Portfolio offers promising insights. The fund primarily focuses on utilities integrating renewable resources into their operations. By working together with partners like Aspire General Insurance, Fidelity is tackling the financial and operational aspects of energy management head-on.

The Impact of First Insurance Funding and Nationwide Partnerships on Energy Mutual Funds

As mutual funds in energy grow, innovative partnerships are reshaping the financial landscape. First Insurance Funding has become crucial by providing specialized insurance solutions that support investments in the energy sector. Their services aren’t just about protection; they enable investors to allocate capital more freely towards sustainable initiatives.

Moreover, alliances between nationwide energy partners and mutual funds are increasingly promoting the integration of renewables. These partnerships strive to back progressive companies that prioritize ecological responsibility, effectively fostering a sustainable energy economy. It’s a collaborative effort to reshape how energy ventures operate financially and socially.

The Future of Energy Investments: A Synergy of Sectors

What does the future hold for energy mutual funds? A confluence of various sectors is ripe for unprecedented growth opportunities. Take Acceptance Insurance, for example, which is actively pushing initiatives to encourage electric vehicle adoption. This unique perspective shows how different industry models can come together to spur energy innovation.

Additionally, support from American Credit Acceptance in clean transportation solidifies how diverse business models can unite to enhance the effectiveness of mutual funds in energy. It’s clear that collaboration across industries is essential for promoting greener alternatives and driving sustainable change.

Wrap-Up

As 2024 unfolds, the landscape for mutual funds in energy is transforming into a dynamic sector that drives societal change. With sustainable investing practices becoming intertwined with financial success, it’s likely that this area will expand — attracting more investors aiming for a sustainable future. The vision of a greener planet isn’t merely a dream; it’s a tangible goal powered by collective commitments to innovation in energy efficiency and responsible investing.

The future of mutual funds in energy reflects an exciting intersection of finance, technology, and environmental responsibility, paving the way for a healthier planet.

Mutual Fund in Energy: Exciting Facts and Trivia

The Rise of Renewable Investments

Investing in a mutual fund in energy can be a game-changer for those looking to support sustainable practices while also reaping potential rewards. Did you know that as of late 2023, the energy sector has seen significant shifts fueled by the global push toward renewable sources? This has led to the growth of numerous investment opportunities, making now a prime time to consider where your dollars might do the most good—financially and environmentally.

Speaking of environmental shifts, let’s take a trip through pop culture. For instance, Griselda Blanco’s young photos offer a glimpse into a bygone era filled with intrigue, much like how the energy sector is evolving and adapting to new challenges. Meanwhile, Nabhaan Rizwan is carving his niche in the entertainment industry, showcasing the kind of tenacity we admire in those driving energy solutions today.

The Benefits of Diverse Portfolios

One interesting tidbit about a mutual fund in energy is its ability to diversify risk through the inclusion of various energy sectors, such as solar, wind, and biofuels. This diversification is akin to the dynamic cast of ‘Tulsa King,’ which thrives on blending different talents to create a captivating narrative. Just as each actor contributes to the overall performance, so too does each energy source bolster a mutual fund’s overall stability.

Moreover, Mamta Kafle bhatt is an exemplary figure in sustainable initiatives, reminding us of the importance of community engagement. This principle resonates with mutual funds that not only aim for profit but also focus on benefiting society at large. With the right fund, investors can be part of a movement pushing for cleaner energy and a healthier planet.

Fueling Future Growth

Curious about how mutual fund in energy investments are impacted by current events? Take, for example, the recent health news surrounding Raquel Colon and her fight with cancer, which underscores the broader importance of clean air and the environment’s impact on well-being. Clean energy can help mitigate such health challenges, reinforcing why investing in this sector matters—not only for financial returns but for the planet’s future.

Meanwhile, let’s not forget about the cultural aspects shaping these investments. The phenomenon known as soaking mormon has intrigued many in popular culture, much like the evolving narratives around sustainability. The conversation surrounding energy isn’t just about numbers; it intersects with lifestyle choices and values, demonstrating how mutual funds can resonate beyond mere financial gain.

In short, a mutual fund in energy isn’t just another investment option—it’s a chance to participate in a future that values both profit and planet. So, as you consider where to put your money, think of it not just as a financial decision but as a stake in a healthier, greener tomorrow. And who knows, perhaps you’ll find inspiration for your next investment strategy while enjoying a meal at a local Beijing restaurant or catching up with the latest on the ‘Bold and Beautiful’ cast. Happy investing!