As we enter 2026, the automotive industry is facing monumental shifts, particularly in the electric vehicle (EV) sector. Among the companies steering through these tumultuous waters is Nikola Corporation, often highlighted for its ambitious goals and strategic outlook. Investors are taking a close look at nikola stock as it navigates this complex landscape, raising important questions about its future growth potential.

Current Performance of Nikola Stock in the Market

The financial scene for nikola stock as of early 2026 tells a story of both promise and challenges. Recently, the share prices have seen significant ups and downs, a pattern influenced by quarterly earnings reports and various industry developments. The latest quarterly earnings reveal a slight increase in sales, thanks largely to their commitment to producing hydrogen fuel cell trucks. Back in 2023, the stock had a notable surge after announcing partnerships with major players like General Motors, only to take a hit later due to supply chain disruptions.

Despite these fluctuations, Nikola’s recent quarterly results show glimmers of optimism. The company reported an increase in its total sales volume, indicating a potential turnaround. Analysts suggest that as more consumers look for sustainable transport options, Nikola’s strategy might pay off, provided the company can effectively manage production and deliver its promises to the market.

Investors’ interest in nikola stock isn’t completely unfounded. The company’s innovative approach to hydrogen technology is drumming up considerable attention. However, whether this translates into long-term gains will heavily depend on how Nikola can sustain momentum in a competitive landscape.

Comparative Analysis: Tesla vs. Nikola Stock

To truly assess the growth potential of nikola stock, it makes sense to compare it to Tesla, the titan of the electric vehicle market. With Tesla boasting a market cap of around $800 billion, the disparity is evident. Nikola, valued at about $5 billion, has quite the mountain to climb. Still, this doesn’t entirely sideline Nikola’s prospects.

| Metric | Nikola | Tesla |

|——————–|——————|———————-|

| Market Cap | $5 Billion | $800 Billion |

| Vehicle Type | Hydrogen Fuel Cell| Battery Electric |

| Partnerships | General Motors, Bosch | Multiple global alliances |

What sets Nikola apart is its innovative product pipeline. The anticipated release of the Nikola Tre hydrogen truck could give the company a competitive edge if the market favors hydrogen vehicles in the coming years. Unlike Tesla, which enjoys a massive scale and advanced battery technology, Nikola has the opportunity to capitalize on its unique approach to sustainable energy solutions.

Yet, it’s essential to acknowledge the market dominance that Tesla currently enjoys. Tesla’s advancements in battery technology and its established user base provide a formidable barrier for newcomers like Nikola. Nonetheless, if Nikola can smartly position its offerings to cater to unanswered needs in the EV market, it might successfully carve out its niche.

The Role of Strategic Partnerships

Examining Nikola’s strategic alliances sheds light on its ambitions for future growth. The partnerships, especially with substantial firms like Bosch, illustrate a commitment to building the necessary infrastructure for hydrogen technologies. This isn’t just a superficial arrangement; it’s a crucial step that positions Nikola to play a major role in developing hydrogen as a viable energy source for vehicles.

Moreover, collaborations with logistics giant Ryder System for distribution signify Nikola’s strategic focus on expanding its operational footprint. These alliances enable the company to improve market access and enhance its supply chain capabilities—critical factors if Nikola seeks to grow in a saturated automotive industry. The company’s partnerships demonstrate a shift away from traditional models, potentially leaving older automotive companies struggling to adapt.

In short, strategic partnerships could be a game-changer for nikola stock. They help cultivate a network that’s essential for executing its business model effectively. By aligning with companies that have a vested interest in sustainability, Nikola is setting itself up for future successes.

Regulatory Landscape and its Impact on Nikola Stock

Entering 2026, the regulatory environment around emissions and sustainability is stricter than ever. This shift favors companies that prioritize eco-friendly solutions, positioning nikola stock in a potentially advantageous light. With stronger environmental policies globally, those firms demonstrating compliance may reap the rewards in the stock market.

Nikola’s focus on hydrogen fuel cells aligns perfectly with these evolving regulations. Analysts indicate that companies that can align with stringent emission standards will likely attract more investment. In contrast, legacy automakers that are lagging in this transition could face penalties that impact stock performance negatively.

As governments worldwide are tightening their grips on carbon emissions, Nikola could find itself ahead of the curve. The company’s sustainable focus on hydrogen aligns with these policies, paving the way for substantial growth opportunities.

Technological Innovations Driving Future Growth

Another critical factor influencing nikola stock is the focus on innovation. The company is diving headfirst into developing next-generation battery technologies, notably solid-state batteries. This strategic move positions Nikola as a forward-thinking player. Unlike other companies, such as Rivian, which have centered mainly on battery electric vehicles, Nikola is diversifying its energy solutions.

As the global demand for alternative fuels escalates, Nikola’s investment in technology could yield serious long-term benefits. This commitment to innovation isn’t just about keeping up with competitors; it’s about taking the lead in offering alternative fuel solutions that are increasingly necessary.

The company’s rapid progress in technology could very well be the driving force behind future gains for nikola stock. If successful, these advancements could set Nikola apart in a crowded market and attract savvy investors looking for sustainable investments.

Market Sentiment and Public Perception

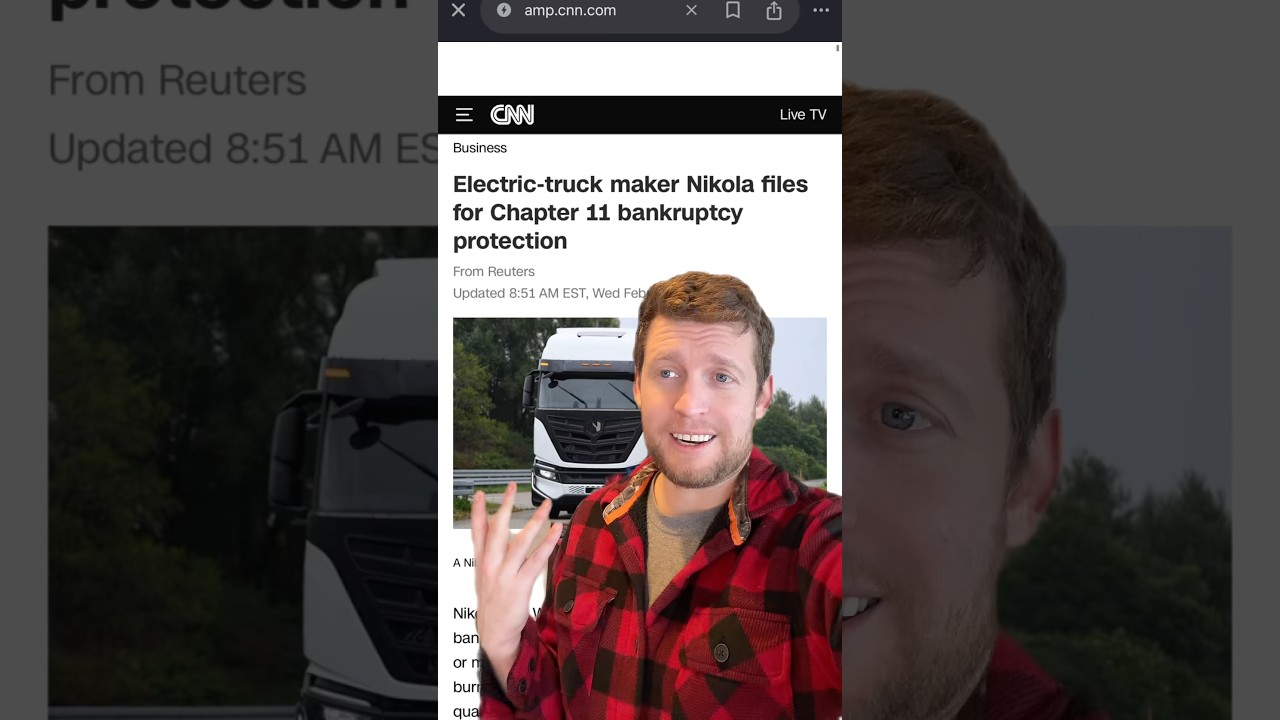

Public sentiment towards nikola stock has changed over time, especially after the controversies surrounding past claims about their technology. However, recent positive media narratives highlighting successful vehicle demonstrations have begun to change the narrative. As individual and institutional investors closely monitor executive strategies, slight changes in market sentiment can have a significant impact.

The company’s attempts at rehabilitation through marketing and successful product launches could buoy consumer confidence. A stock’s performance can often be swayed by public perception; if Nikola continues on this upward trajectory, it could amplify interest in its stock.

Ultimately, the relationship between public perception and financial success is undeniable. For nikola stock, maintaining positive media coverage while delivering tangible results will be vital to establishing lasting investor trust.

Future Projections: What Lies Ahead for Nikola Stock?

Looking forward, various predictions exist for nikola stock. Optimistic analysts believe that if Nikola efficiently scales its production capabilities and successfully launches new vehicles, it could achieve profitability by the end of 2026. This good news could even trigger interest from big-name investors waiting to jump in.

On the flip side, pessimists caution against too much exuberance, citing potential barriers like competition and regulatory challenges nudging the company off course. The path ahead holds both promise and pitfalls; the company’s success hinges on executing its innovative strategies effectively.

As we contemplate the current landscape, the future of nikola stock is a blend of promise and uncertainty. With strategic partnerships, a focus on technology, and responsive approaches to regulations guiding its journey, Nikola seems poised at a crucial junction. Investors should stay vigilant in monitoring market trends and the company’s ability to maneuver through this rapidly changing industry. The real test lies in turning vision into sustainable success in the years to come.

In conclusion, while nikola stock may carry its share of risks, its commitment to innovation and strategic partnerships presents an exciting yet unpredictable pathway forward.

Nikola Stock: Fun Facts and Trivia

The Up-and-Coming Market

If you’re keeping an eye on nikola stock, you’ve probably noticed it’s been quite the roller coaster. Did you know that Nikola Corporation has been focusing on developing hydrogen and electric-powered vehicles? This shift puts them in league with major players and sparks curiosity about their growth potential. In the world of sports, interestingly, Malik Monk has also shown impressive growth this season, drawing comparisons in how emerging talents shape their respective fields.

Industry Innovations and Influencers

As Nikola pushes forward, the innovation landscape is shifting dramatically. For instance, the push for sustainable transport has everyone buzzing. It’s reminiscent of how Steve Ballmer revitalized the tech sector, often blurring lines between personal style and professional success. You might wonder about the potential impacts of state policies too! Jared Polis, the Governor of Colorado, has been a vocal advocate for renewable energy. His efforts reflect the same enthusiasm Nikola hopes to harness in production.

More Than Just Vehicles

But Nikola’s journey doesn’t stop at hydrogen trucks. Fun fact: the company is venturing into advanced technologies, which could reshape how we think about transportation. As homes get more tech-savvy, the use of Rfid wallets is on the rise, reminding us that innovation isn’t restricted to one area. Like Brian Jordan alvarezs comedic take that entertains while addressing social matters, Nikola might just carve out its niche in an industry ripe for humor and ingenuity. And speaking of entertainment, the ups and downs within Nikola stock are no less dramatic than the stories of Tom Sizemore, who had his own turbulent tales in Hollywood.

In conclusion, while we ponder where nikola stock will go next, remember this journey is filled with potential, innovation, and some surprising connections. Who knew that a company dedicated to sustainable transportation could weave through topics as diverse as men’s dress sneakers and Woo Lottis latest tracks? It’s a vast landscape, and Nikola’s evolution will certainly continue to surprise and engage investors and enthusiasts alike.