The Role of NYSE in Today’s Financial Ecosystem

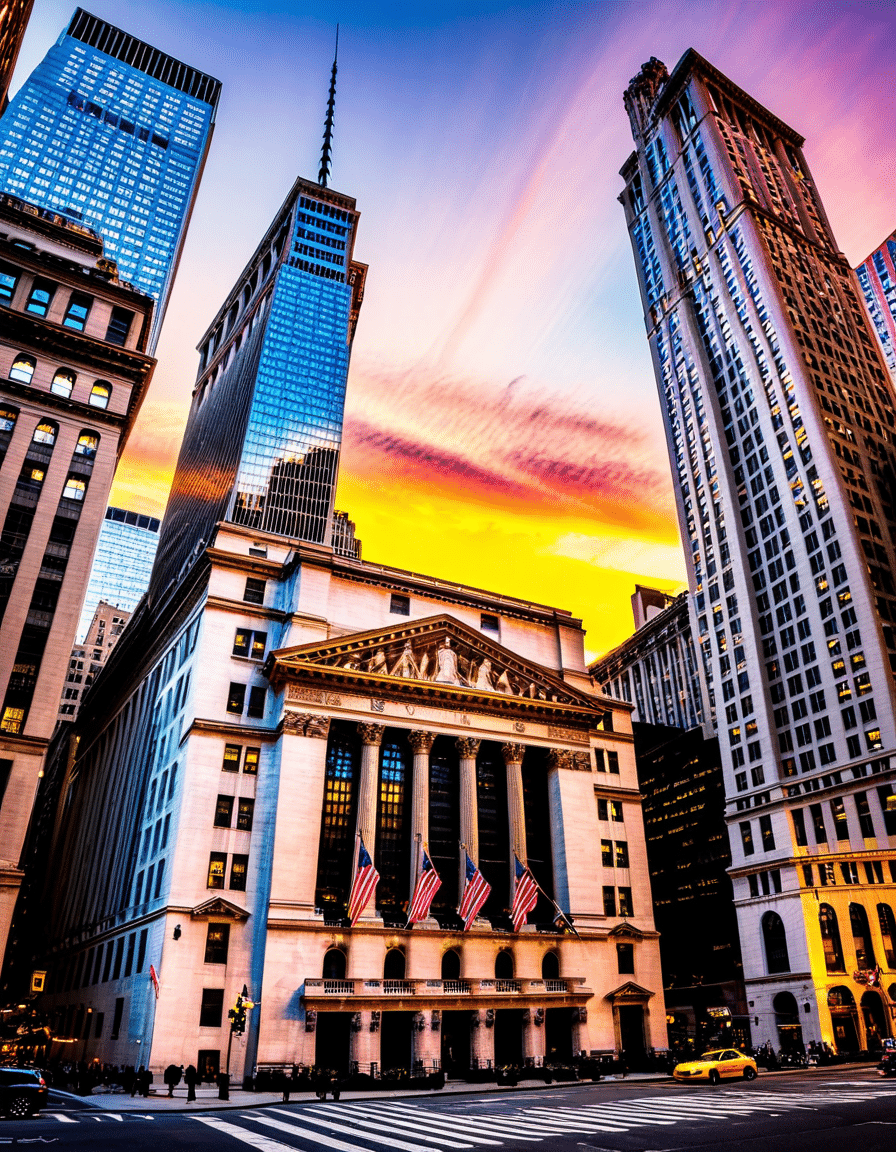

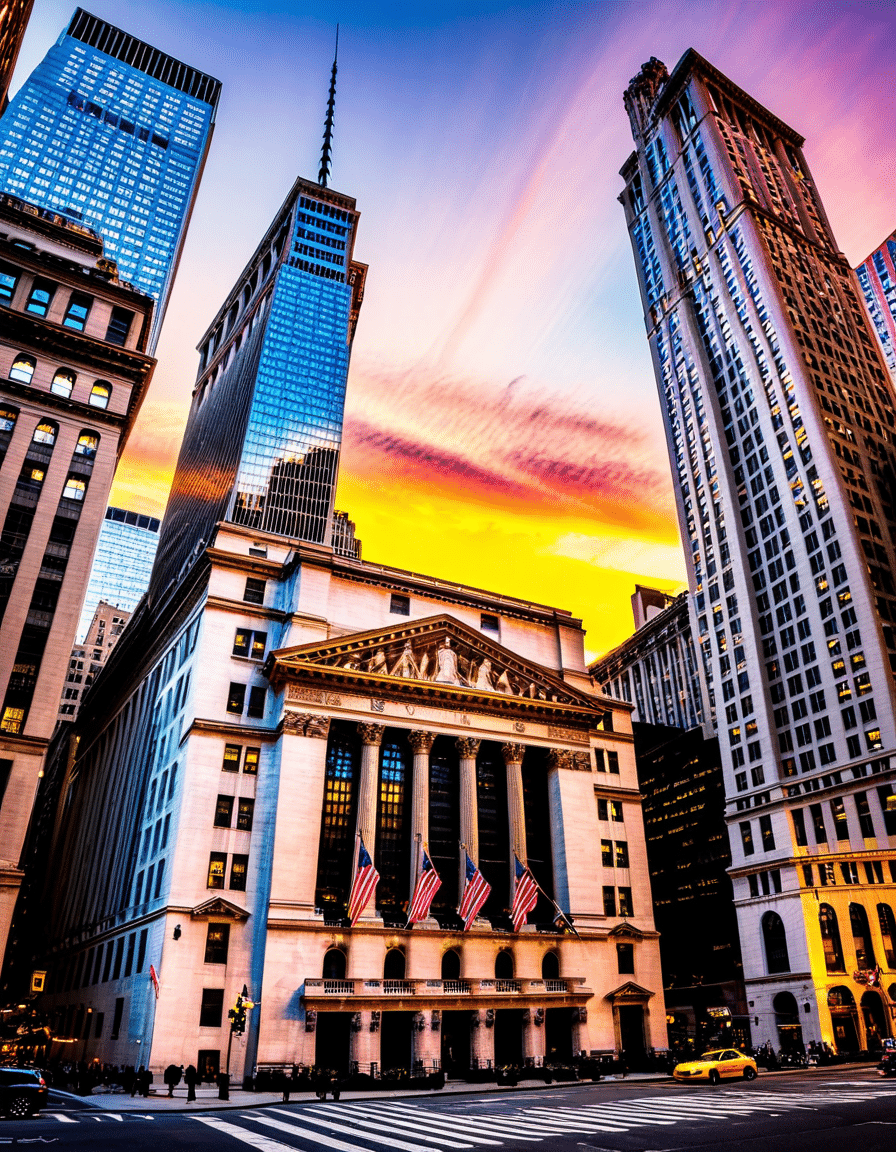

The New York Stock Exchange (NYSE) stands proudly as the largest and most influential stock market, acting as a vital heartbeat for global financial markets. Since its inception in 1792, the NYSE has morphed into a complex ecosystem that doesn’t just facilitate trading but also promotes financial transparency and the effective allocation of capital. In this hyper-interconnected world, shifts in the NYSE reverberate across economies, impacting everything from policy decisions to investor sentiment.

As the U.S. economy continues to evolve, the NYSE serves as a key indicator of economic health. Price movements, trading volume, and the performance of listed companies reflect broader trends and indicate how domestic and global investors respond to various situations. The NYSE is not just a U.S. phenomenon; it influences global economies, acting as a compass for financial strategies that shape markets as far away as Asia and Europe.

With a great sense of responsibility, the NYSE also promotes trust and reliability in the financial system. By sticking to rigorous listing standards and providing accurate information, it nurtures a culture of accountability among firms. This accessibility helps smaller investors feel secure in their journeys within the market, further solidifying the NYSE’s role as an empowering platform for economic engagement.

Top 7 Factors Connecting NYSE and Economic Dynamics

The NYSE features a staggering market capitalization exceeding $26 trillion, standing tall as the largest stock exchange globally. This immense figure reshapes global investment strategies, guiding investors to look to the NYSE for hints on where they should pool their money. When the NYSE experiences significant drops, global markets twitch, and investors from places like Tokyo to London feel the ripple effects.

High-frequency trading (HFT) has dramatically altered how transactions occur on the NYSE. Companies like Citadel Securities utilize cutting-edge technology to execute trades at breathtaking speeds, handling algorithms that instantly react to market changes. For example, during the COVID-19 pandemic, these instant reactions brought tangible impacts on the stock prices of commodities, currencies, and bonds, demonstrating that speed truly matters in today’s financial arena.

Global giants like Alibaba and Tata Motors flock to the NYSE for their listings, tapping into the U.S. investor base. This trend bridges different financial markets and grants foreign companies access to substantial capital. Such increased connectivity facilitates dynamic conversations about international investment, impacting how funds flow into emerging markets.

The NYSE serves as a lens through which critical economic indicators are analyzed. Factors such as unemployment rates and consumer spending can drastically influence stock performance. For instance, if unemployment spikes, the NYSE may see a dip in stock indices. Firms like Goldman Sachs closely monitor these connections, adapting their forecasts based on data drawn from the NYSE.

The NYSE reacts swiftly to global events—like geopolitical conflicts or environmental crises. For instance, tensions in Eastern Europe have stirred fluctuations in energy stocks, underscoring how external factors propel investor reactions. Monitoring the NYSE’s movements during such events presents a clear picture of its central role in global finance happenings.

Environmental, Social, and Governance (ESG) factors are now at the forefront of investor interests. Companies listed on the NYSE, like Tesla and NextEra Energy, are championing sustainability, reshaping how investors assess market dynamics. The NYSE’s increasing commitment to responsible investing highlights its role in aligning financial opportunities with societal expectations—a connection growing stronger in today’s market.

Currency values can sway stock prices significantly in NYSE-listed companies. If the U.S. dollar strengthens against the euro, U.S. firms might find their European exports priced out of the market. This reality compels analysts to delve into foreign exchange trends to make informed predictions about U.S. businesses on the NYSE.

Building Connections in Today’s NYSE Landscape

In the modern financial ecosystem, the NYSE thrives on numerous connections with media and traders. Platforms like The New York Times (NYT) provide insights that actively shape trading decisions. By discussing market trends and offering evaluations, these connections spotlight the intertwining of journalism and finance, enhancing how investors digest market information.

This relationship works both ways; the NYSE sends ripples through news narratives, prompting journalists to pursue compelling stories. By reporting on economic analytics, corporate earnings, and speculative trading perspectives, financial journalism paints a vivid picture of the investment landscape. As NYT connections explore these themes, they showcase the profound impact of market fluctuations on daily life.

Additionally, the NYSE acts as a bellwether for changes in investor sentiment, addressing critical moments that spark public interest. The continuous exchange of information between the NYSE and media outlets exemplifies an essential partnership that drives the dialogue around money and markets.

Reimagining Financial Futures

More than a trading venue, the NYSE represents a global stage showcasing economic stories that unfold every day. As we venture onwards in 2026, embracing the complexities of the NYSE and acknowledging its wider implications becomes even more crucial. The interplay of technology, economic indicators, and global events weaves a narrative essential for investors and analysts alike as they seek clarity amidst fluctuations.

In this interconnected environment, stakeholders aren’t just observers; they’re integral players shaping the financial landscape’s evolution. The NYSE’s lively pulse resonates with the aspirations and challenges faced by businesses and economies, rendering attention to its rhythm vital for anyone looking to engage with finance’s future.

As we move forward, understanding the heartbeat of the NYSE—its connections with firms like Uc San diego and insights from the NYT—will empower investors to make informed decisions while navigating their financial journeys. Ultimately, keeping an ear to the ground allows stakeholders to remain attuned to the latest trends, fluctuations, and opportunities in this vibrant marketplace.

NYSE: The Heartbeat of Global Financial Markets

Did You Know?

The New York Stock Exchange (NYSE), the largest stock exchange in the world, has some fascinating trivia that may surprise you. For starters, the NYSE was founded in 1817, making it over 200 years old! Back then, traders would meet under a buttonwood tree on Wall Street to negotiate deals. Fast forward to today, and you’ll find a bustling hub of financial activity that resembles the lively atmosphere of a major sports event, like a thrilling match between the PSG vs Liverpool. Investors flock to the NYSE much like fans gather for a big game, showcasing just how integral it is to the flow of global economy.

You might wonder how stocks are priced on this venerable exchange. Well, prices are dictated by supply and demand—much like the way people argue over which team will win in a rivalry series, like Netherlands vs England. Interestingly, the exchange still sees over 80% of its trading done via electronic systems, though a small percentage occurs through the traditional auction system. This blend of history and modern technology reflects the NYSE’s unique position in a constantly shifting financial landscape.

Fun Facts and Figures

Among its many quirks, the NYSE has its own set of unofficial mascots. In recent years, financial memes, such as some hilarious Thanksgiving memes, have captured the imaginations of investors and comedians alike. These snippets of humor break the often tense atmosphere of trading, proving that laughter is just as essential in the stock market as numbers on a screen. And speaking of visuals, the vibrant neon green of the trading floor’s ticker tape can be seen lighting up the evening sky, a testament to its enduring significance.

Further down the rabbit hole of trivia, did you know that the NYSE is home to more than 2,800 companies? Many of these firms boast impressive legacies, including those that stretch right into Hollywood—take a look at the cast of major motion pictures! And just like any huge cultural event, the NYSE hosts its own share of significant dates and milestones. Remember Black Friday in retail? The NYSE hosts its own version with companies competing for that dash for dollars, especially during events like Best Buy Black Friday. The financial sector truly captures the essence of festive shopping in its very own way.

As a cornerstone of global finance, the NYSE reflects a tapestry of stories and triumphs, weaving together the threads of economics, culture, and innovation. From stock prices to market fluctuations, it’s always an exciting ride. So, whether you’re a seasoned trader or a curious newbie, keep an eye on this monumental exchange—it’s a lively show, like one featuring Pooh Shiesty that keeps fans talking long after the curtains close!