Unpacking the Social Security Increase 2025 and Its Impact

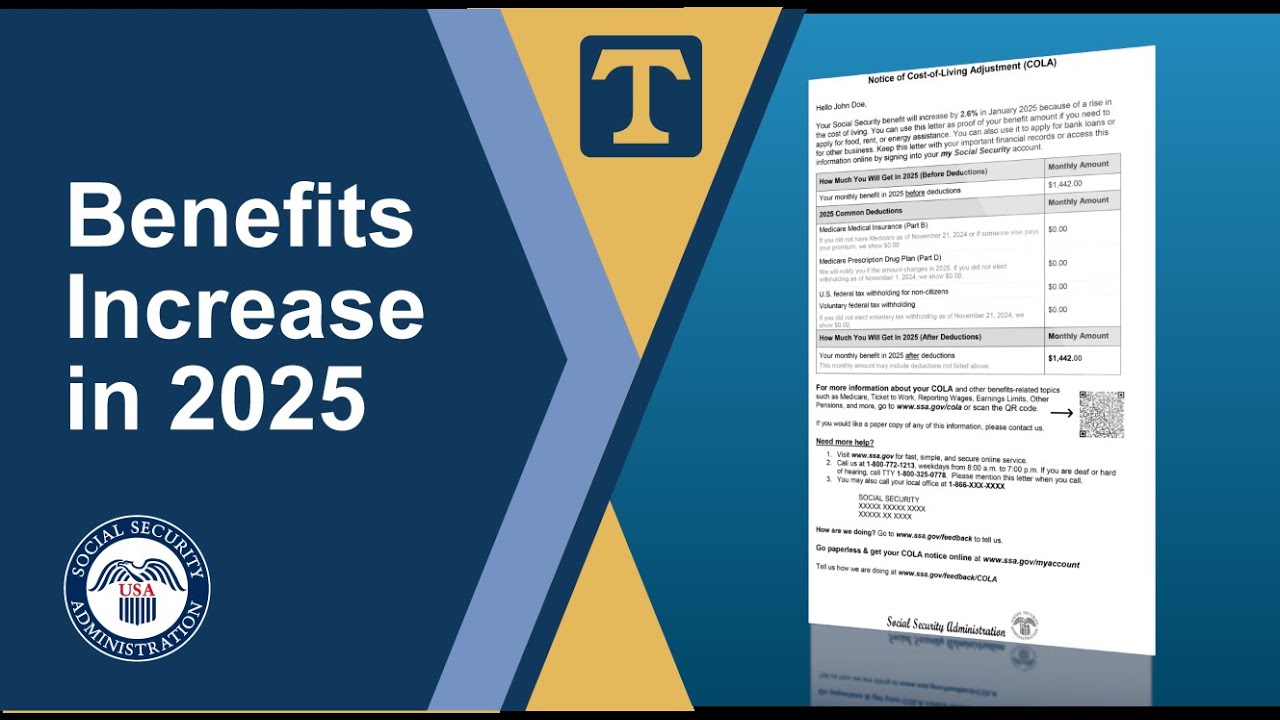

The Social Security increase 2025 isn’t just numbers on paper; it’s a vital resource for millions of Americans who rely on these payments to stay afloat. Following a striking 10.5% cost-of-living adjustment (COLA), beneficiaries experienced the highest payment increase in decades, making headlines and shifting expectations. The 2025 Social Security COLA increase aims to alleviate the financial toll that inflation has taken, especially for retirees and disabled Americans who often live on fixed incomes. As we dive into the details, it’s crucial to understand how this increase stands to reshape financial realities for countless households across the nation.

Many beneficiaries report feeling an immediate sense of relief. Take Mary Thompson, an 82-year-old retiree from Minneapolis. Thanks to the increase, she saw her monthly income rise by around $200. This boost allows her to afford necessary medications and even a few healthier food options that she previously struggled to incorporate into her limited budget. Such changes promise enhanced well-being for many, indicating the profound impact of the 2025 Social Security COLA increase.

The 2025 COLA adjustment is also a checkpoint for policymakers who have long debated how to maintain the program’s sustainability amid rising costs. As debates swirl around the future of Social Security, the recent increase brings renewed urgency to discussions about the long-term viability of this essential support system. Will this set a precedent for future adjustments? Only time will tell, but the winds of change are undeniably blowing.

The Top 5 Effects of the Social Security COLA Increase 2025

The Social Security increase 2025 means more secure finances for millions of seniors. With healthcare costs rising steadily, the extra funds can dramatically ease their financial strain. A report from the Center on Budget and Policy Priorities highlights that for many seniors, this increase translates to more than just numbers—it’s life-changing. Mary Thompson’s experience echoes this sentiment; the additional monthly income enables her to prioritize her health, offering a slice of normalcy during challenging times.

An interesting side effect of increased funds for retirees is the positive ripple effect on local economies. As seniors have more disposable income, many will pump their earnings back into communities. Businesses like Nancy’s Bakery in Miami are already picking up on this trend, bracing for higher sales driven by retirees’ increased purchasing power. Industries catering to older adults, from dining to healthcare services, can also expect a noticeable uptick in demand as more savvy seniors spend their freshly minted dollars.

The 2025 Social Security COLA increase has significant implications for housing stability among retirees. With this financial boost, many seniors can afford essential living costs without compromising their housing status. Take David Anderson, for example. Living in Cleveland at 72 years old, he used the additional funds to carry out necessary repairs on his home, which not only improved his living conditions but also lifted his spirits. Safe housing fosters a sense of pride and security, especially for those who’ve worked their entire lives to achieve it.

With the extra cash flow, many seniors can prioritize mobility, investing in transportation that makes them feel liberated. Jane Reed, a 68-year-old resident of San Francisco, recently reported that the increase allows her to cover public transit costs, enabling her to stay socially engaged and active. Loneliness often plagues the elderly, and having the means to get out and about can lead to improved mental health. Social interaction is crucial, and this increase in funding represents a tangible step towards reducing isolation.

The Social Security increase 2025 doesn’t just benefit retirees; it extends vital support to caregivers as well. Many families can now allocate some of the additional funds toward hiring help for their elderly loved ones. For instance, the Jones family in Austin used their new monthly allowance to afford part-time assistance for their 80-year-old mother. This not only relieved stress for the family but also provided her with additional companionship and care, further supporting her independence in a safe and nurturing environment.

Long-Term Implications of the 2025 Social Security COLA Increase

The long-term consequences of the 2025 Social Security COLA increase are significant and far-reaching. This adjustment could trigger a reevaluation of how benefits are calculated, reflecting the mounting economic challenges that seniors face. As the cost of living continues to climb, it’s likely we’ll witness more frequent discussions in Congress about reforming Social Security to better align with today’s economic realities. This upward adjustment signals an acknowledgment of the needs facing not just current retirees but also future generations.

As financial experts, including Julie Thompson from New York, have pointed out, planning for retirement now entails accounting for these adjustments more rigorously. With inflation continuing to be a prevailing issue, better financial strategies will become essential for ensuring a comfortable retirement. As more people are adjusting their expectations, it underscores the importance of developing a comprehensive approach that considers these new dynamics.

Additionally, discussions surrounding sustainability will only grow more urgent as policymakers and advocates begin to recognize the implications of these changes. The shift to a more adjustable Social Security system could herald a new era—one where government support adapts while aiming to provide stability to the aging population.

A Transformative Shift in Perspective

The 2025 Social Security increase represents more than an adjustment; it’s a fundamental shift in how we support our aging citizens. With inflation’s effects lingering over daily expenses, this adjustment is a step towards honoring the commitment to those who’ve contributed to society through decades of hard work. As society moves forward, it’s imperative we acknowledge both the achievements and struggles of retirees and advocate for sustainable solutions to ensure their dignity and quality of life.

This moment serves as an opportunity to reflect on past policies and inspire proactive discussions for the future of Social Security. Advocacy remains key, as our collective responsibility is to push for systems that uplift retirees, allowing them to thrive rather than merely survive in their golden years. Together, we can create a supportive framework that not only acknowledges the sacrifices of those who came before us but also guarantees secure futures for generations yet to come.

In these dynamic times, ensuring adequate support for our elderly is not just the right thing to do; it’s essential for a society that values compassion and unity. The 2025 Social Security COLA increase illustrates the potential for positive change—a reminder that a lift in income can have a profound impact on quality of life. As we continue our journey forward, let’s remain dedicated to advocating for solutions that make a difference in the lives of millions.

Social Security Increase 2025 Set to Transform Lives

A Look Ahead

Exciting changes are on the horizon with the social security increase in 2025, promising to have a profound impact on many lives. But did you know that the first Social Security Act was signed into law in 1935? That’s nearly a century of evolving policies that have shaped how millions experience financial stability. Just like how sports fans eagerly await exciting tournaments like the Supercopa de España, citizens are equally enthused about the impending boost to their financial safety net.

The 2025 increase will not only provide more significant benefits to retirees but will also extend help to individuals unable to work due to disability. In a world where even young people face challenges similar to those depicted in epic tales like One Piece : The Movie, it’s essential to have that safety net. Moreover, this increase could allow folks to pursue passions previously put aside—maybe even adopting a charming pet like a Shiba Inu!

The Historical Context

Transformations in social security benefits have always been tied to economic shifts. For instance, the changes in 2025 will reflect current living costs much like comparing the legacy of the best Nba Players Of all time to the growing talent in recent leagues. Financial support acts as a lifeline, similar to how Jon Snows rise in “Game of Thrones” symbolizes hope and resilience amid turbulence (Jon Snow).

It’s fascinating to note how the allocation of benefits has often been a topic of hot debate. Some might say it feels like asking, Where Is Your appendix? right before a tough operation (where is your appendix). But just like navigating through life’s ups and downs, these changes aim to provide clarity. Each boost can help folks better navigate daily expenses, healthcare, and unexpected emergencies.

The Living Legacy

As we inch closer to 2025, one can’t help but wonder—for many, this social security increase will symbolize not just monetary relief but also a lifestyle shift. This context is especially resonant for families, where support can enhance living conditions. For instance, Taylor Swift’s mother explains how familial bonds and support can shape personal journeys Taylor Swift mom).

Given how life is unpredictable, the effect of the social security bump is undeniable. It could allow for essential upgrades in life, similar to how one might think about whether an home equity loan Requires Homeowners insurance when making financial decisions. Each adjustment in policy reflects a society that values its people. Whether you’re a retiree or just starting your journey into independent living, the upcoming changes can feel like a welcomed lifeline.

So, as we await these transformative adjustments, it’s as if we’re sharing a collective heartbeat, much like how the letters of a fun game of Word Q come together to form meaningful stories. Here’s to hoping that the social security increase in 2025 shapes many lives for the better!