As we step into March 2026, millions of Americans eagerly anticipate their social security payments this month, which are bigger than ever before. This month’s disbursements reflect a significant increase compared to previous years, driven by adjustments intended to keep up with inflation and the rising cost of living. In this article, we’ll break down the specifics of social security payments this month, focusing on the expected benefits and how they stack up against previous years.

Top 5 Insights on Social Security Payments This Month

In March 2026, beneficiaries will see a noticeable bump in their social security payments compared to March 2025. Thanks to the Cost-of-Living Adjustment (COLA), this year’s increase clocks in at 6.5%, a sizable leap from last year’s 5.9% adjustment. This enhancement strives to counteract the erosion of purchasing power due to inflation, which has ramped up significantly over recent years. For retirees, this increase is more than just a statistic; it’s a lifeline amid soaring living costs.

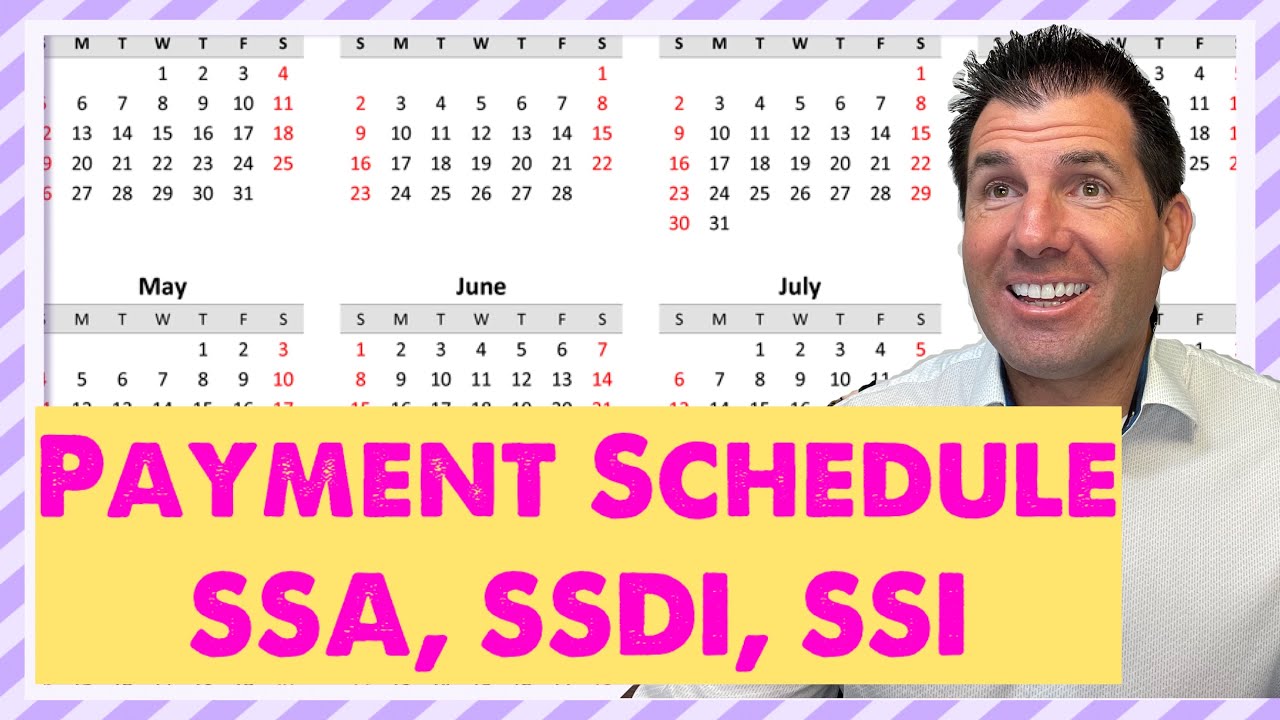

For those awaiting their payments, knowing the schedule is key. Social security payments in March 2026 will be issued on the second, third, and fourth Wednesdays of the month, based on recipients’ dates of birth. Specifically, the March 26 social security payments are designated for beneficiaries born between the 11th and 20th of the month. This structured approach helps ensure nearly 20 million recipients receive timely financial support.

The surge in social security payments this month doesn’t just affect individuals; it has far-reaching implications for the economy. Around 70% of retirees depend on social security as their main source of income. This increase boosts their financial health and stimulates local economies since seniors tend to spend their benefits on essential goods and services, effectively energizing community businesses.

Cities like Miami and Philadelphia have reported a noticeable uptick in local business activity owing to increased consumer spending from social security payments. Take Mabel’s Grocery in West Philadelphia—it experienced a 15% increase in sales since the last COLA adjustment in September 2025. This rise directly correlates with the financial relief provided to seniors, showcasing how social security payments can invigorate communities.

As we look ahead, economists are pondering the sustainability of the social security fund amid these increased payments. While current funding allows for this year’s enhancements, future challenges loom on the horizon. With an aging population and a growing number of beneficiaries, policymakers are under pressure to consider reforms that could secure the future of social security without overburdening taxpayers.

Understanding the March 2025 Social Security Payments Context

To appreciate the generous benefits this month, we need to look back at last year’s framework. In March 2025, social security payments provided a more modest increase that fell short of keeping pace with soaring living costs. Beneficiaries received only slight adjustments while inflation escalated, leaving many scrambling. This stark contrast frames the increased importance of this month’s disbursements.

A Closer Look at March 26 Social Security Payments

March 26 stands out as a vital date for countless seniors excitedly awaiting their social security payments. It carries immediate financial implications and highlights the ongoing struggle between inflation rates and fixed incomes. In a society grappling with rising costs, understanding this date is pivotal, underscoring the efforts for financial stability during uncertain economic times.

Embracing Financial Security and Strategy

For numerous seniors, the enhanced social security payments this month signify more than just numbers in a bank account; they symbolize newfound financial security that enables managing healthcare expenses, housing needs, and even leisure activities. It’s a chance for individuals to better strategize their budgets, ensuring their limited income stretches throughout the month, while also allowing for some savings for unexpected emergencies.

Looking Ahead: The Imperative of Adaptation

Reflecting on the shifts in social security payments shows that discussions around policy updates, responses to inflation, and financial strategy are more vital than ever. As changes loom on the horizon, both individuals and policymakers must navigate this dynamic environment to protect the financial well-being of our aging population. The adjustments made in March 2026 serve as a lesson in economic resilience and a call to action for plans that foster financial stability amidst change.

Social security payments this month are more than just financial numbers; they embody hope, security, and ongoing dialogue around future policies. As we embrace these payments, it’s essential to continually evaluate their impact on individuals and communities alike, helping us plan for a more secure financial future.

Social Security Payments This Month Are Bigger Than Ever

A Historical Peak

Did you know that social security payments this month stand at an all-time high? That means more dollars for seniors and individuals with disabilities than we’ve seen before! It’s pretty fascinating to think about how these payments evolve. Speaking of growth, have you seen the evolution of popular culture? Just like the film and TV universe featuring Rosario Dawson in various movies, the story of social security reflects changing times and priorities. And while we’re on the topic of change, check out how advancements in technology, like those associated with Sundar Pichai, impact finances today!

The Big Picture

Bigger social security payments this month also bring some interesting trivia. For instance, the annual cost-of-living adjustment (COLA) is a critical factor in this rise. It’s determined largely by inflation, meaning the cost of everyday goods can affect your benefits. Just like a holiday plant, the poinsettia—a symbol of seasonal change—these payments shift and bloom based on economic trends. Speaking of shifts, consider the War Of The Worlds narrative—which reminds us how perspectives change over time, even in finance!

Fun Facts and Insight

While social security payments this month shine bright in the spotlight, they also pave the way for more discussions about financial well-being. Ever wondered if conditions like depression are influenced by genetics? This is crucial when discussing financial stress and social programs, as people grapple with issues that affect their quality of life. In addition, if you’re looking to boost your energy during the month, products like bucked up might just be what you need! With these updates and benefits in play, remember that intelligence in financial decisions also resembles the humor found in shows like Family Guy—where sometimes you just have to laugh through the chaos.

In a nutshell, with social security payments this month reaching unprecedented heights, we not only gain financial assistance but also indulge in rich discussions about its broader implications on everyday life.

Why am I getting another Social Security check this month?

If you’re seeing another Social Security check this month, it could be due to a special payment, changes in benefit schedules, or adjustments made for certain situations like back payments.

What day will Social Security be deposited this month?

Social Security payments are typically deposited on the second, third, and fourth Wednesdays of each month, depending on your birth date.

When my ex-husband dies, do I get his full Social Security?

When your ex-husband passes away, you can receive benefits based on his record, but it usually won’t be the full amount if you’ve remarried or if he wasn’t fully insured.

Are people on Social Security getting $250?

Yes, there are reports of a one-time $250 payment being issued to some Social Security recipients, but it’s often tied to specific criteria.

Is Social Security really sending out extra checks?

Social Security has recently issued some special extra checks to help individuals cope with rising costs, in addition to regular monthly payments.

How do you get the $16728 Social Security bonus?

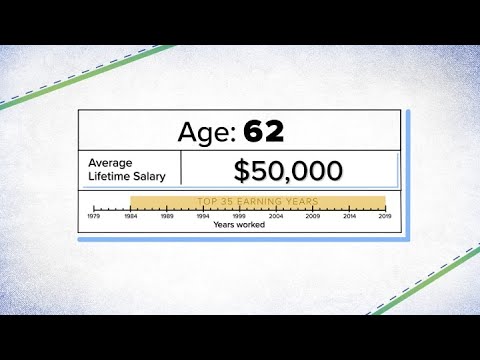

To get the $16,728 Social Security bonus, you may need to work and pay into the system for at least 35 years and maximize your lifetime earnings in those years.

What is the new Social Security payment?

The new Social Security payment may refer to updated benefit amounts adjusted for inflation or other changes happening in the current year.

Who gets the last Social Security payment after death?

After someone passes away, the last Social Security payment typically goes to their surviving spouse or dependent children, depending on individual circumstances.

Why did I get a one-time payment from Social Security?

A one-time payment from Social Security could be due to emergency relief measures or adjustments for certain groups of beneficiaries.

Can I collect 100% of my ex-husband’s Social Security?

You can collect up to 50% of your ex-husband’s Social Security benefits if you meet certain age and duration qualifications.

Can my wife get Social Security if she never worked?

Even if your wife never worked, she may still qualify for Social Security benefits based on your work record, as long as you meet the necessary requirements.

What rights does an ex-wife have when her ex-husband dies?

An ex-wife has rights to claim benefits based on her ex-husband’s record, especially if they were married for at least 10 years, and these benefits could extend to widow/widower benefits if he passes away.

What is the $943 Social Security payment?

The $943 Social Security payment might refer to a specific purchasing power adjustment or a set monthly benefit amount for certain recipients.

Are Social Security recipients getting a $2000 stimulus check?

No, Social Security recipients aren’t receiving a $2,000 stimulus check, but there are ongoing discussions about financial support for people on fixed incomes.

Why are Americans getting a $4800 Social Security check?

Americans receiving a $4,800 Social Security check may be benefiting from emergency measures, cost-of-living adjustments, or other special provisions put in place.

What time does social security direct deposit hit?

Direct deposits for Social Security hit accounts early in the morning, typically by 3 a.m. on the payment dates.

Will Social Security recipients get two SSI checks in May?

Yes, some Social Security recipients might get two SSI checks in May if payment schedules align due to special adjustments or holiday considerations.

What is the cola payment for Social Security on May 14?

The COLA payment on May 14 refers to cost-of-living adjustments designed to help Social Security recipients keep pace with inflation.

Why is my social security direct deposit late this month?

If your Social Security direct deposit is late this month, it may be caused by banking issues, holidays, or administrative delays.

Who is eligible for the Social Security bonus?

Eligibility for the Social Security bonus often depends on your work history, the number of years you’ve contributed, and your total lifetime earnings.

Why are some people getting two Social Security checks in May?

Some people are getting two Social Security checks in May due to adjustments made for their specific payment timing or to catch up on delayed benefits.

What is the one time emergency payment for SSI?

The one-time emergency payment for SSI is aimed at providing immediate financial relief to eligible recipients during times of need.

Is it true we’re getting two Social Security checks in November?

As of now, there isn’t confirmation about getting two Social Security checks in November, but stay tuned for updates about payment schedules.