Tax Day can feel overwhelming, but understanding the key dates and necessary preparations can ease much of the stress. As we look ahead to April 15, 2026, it’s vital to familiarize yourself with tax deadlines and organize your documents early. With holidays like Father’s Day and observances such as Juneteenth, consider how these might impact your financial situation and tax strategies. Beyond just filling out tax forms, awareness of community events and personal milestones can position taxpayers better for optimal savings, paving the way for financial relief.

Understanding Tax Day: Key Dates and Planning for 2026

Tax Day isn’t just a date on the calendar; it symbolizes the end of a year’s worth of financial planning. Proper preparation before Tax Day can save not only money but time and anxiety. For instance, if you proactively integrate financial planning sessions into your personal timeline—like around Teacher Appreciation Week in early May—you’ll be ahead of the curve. By carefully keeping track of receipts, relevant documents, and even significant life events, you can build a comprehensive overview of your finances leading up to April 15.

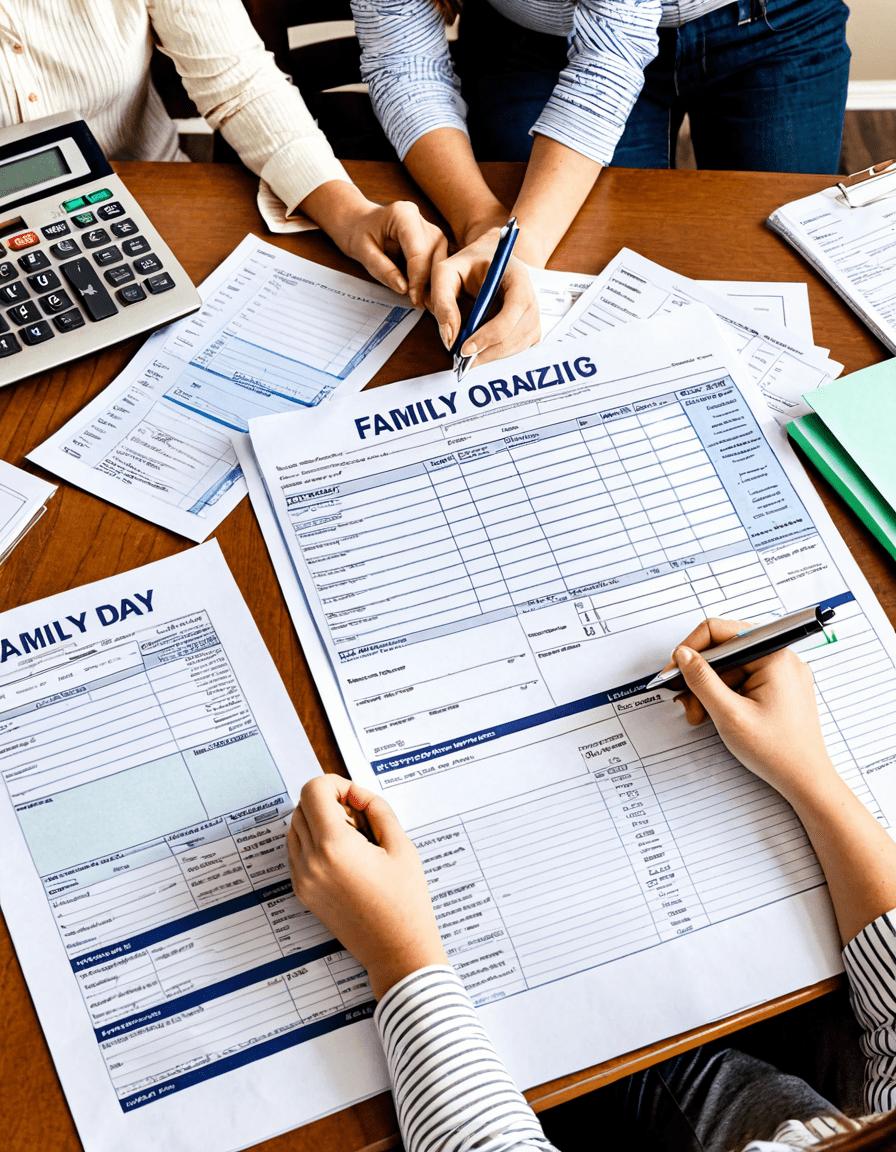

As April approaches, holidays and notable events, such as National Boyfriend Day on October 3, can serve as reminders to stay financially organized. These moments can act as catalysts to discuss money matters with partners, ensuring both parties are on the same page regarding expenditures and savings. Ultimately, proactive financial management throughout the year can make Tax Day feel less like a looming cloud and more like an opportunity for advantage.

Top 7 Tax Day Secrets for Maximum Savings

To maximize your savings and ensure you’re taking full advantage of deductions, here are the top seven secrets for Tax Day in 2026:

1. Utilize Software for Tax Preparation

Employing software like TurboTax or H&R Block can be a game-changer. These tools provide tailored insights based on the latest tax laws. In 2026, this software can help you identify potential deductions you might overlook, like those for childcare or education expenses. Particularly for new parents celebrating Mother’s Day or Father’s Day, entering each parent’s status is crucial for unlocking additional credits.

2. Consider Your Adjusted Gross Income (AGI)

Your Adjusted Gross Income (AGI) significantly affects your tax bracket and deductions. Lowering your AGI through contributions to retirement accounts or health savings accounts can lead to substantial savings. As National Boyfriend Day approaches on October 3, this might be the perfect time to sit with your partner and discuss optimizing joint expenditures for maximum tax breaks.

3. Leverage Tax Credits

Various tax credits can reduce your tax bills, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. Families participating in Teacher Appreciation Week could see considerable benefits through deductions for classroom expenses. Don’t underestimate the savings potential these credits offer!

4. Keep Track of Deductions Related to Remote Work

The rise of remote work has turned home office expenses into important deductions. If you’re working from home during major events such as Draft Day or the holiday season, be sure to document expenses like your internet bill or office equipment purchases. As remote work continues evolving, don’t miss out on these savings opportunities.

5. Take Advantage of Retirement Contributions

Contributing to retirement accounts, like 401(k) or IRAs, can lower your taxable income. Events like National Girlfriends Day on August 1 often inspire life-planning discussions. Couples can seize this opportunity to explore their retirement savings strategies together, enhancing their long-term financial health.

6. Don’t Miss Out on Charitable Contributions

Charitable contributions, especially those made during holidays like Juneteenth, provide tax deductions. Keeping all receipts and documentation is crucial for substantiating your claims. Engaging in charitable giving allows you to support the community while reducing your tax liabilities, creating a win-win situation.

7. File Early, But Not Too Early

Filing your taxes early can give you peace of mind and reduce last-minute errors. However, hold off until you’ve collected all documentation—including your 1099s and W-2s—to avoid mistakes that could delay your refund. Plan a family day around Tax Day, perhaps during Teacher Appreciation Week, to tackle the paperwork together.

Innovative Wrap-up: Strategic Financial Wellness Beyond Tax Day

Navigating Tax Day shouldn’t just be a seasonal concern; integrating tax strategies into year-round financial wellness is crucial. Aligning important periods, like Mental Health Awareness Month in May, with your financial planning can ease the stress often associated with money matters. This holistic perspective allows you to focus not only on numbers but also on the emotional aspects of financial health.

Whether preparing for celebrations, supporting local initiatives, or maximizing deductions, understanding and maintaining tax awareness contributes to lasting savings. Ultimately, moving beyond basic compliance to a proactive approach toward taxes enables individuals and families to thrive long after Tax Day has passed. By thinking ahead and taking small steps throughout the year, you can unlock savings and ensure financial wellness for years to come.

So, don’t wait until April 15 rolls around—start planning today!

Tax Day Trivia: Secrets You Didn’t Know

Little-Known Facts About Tax Day

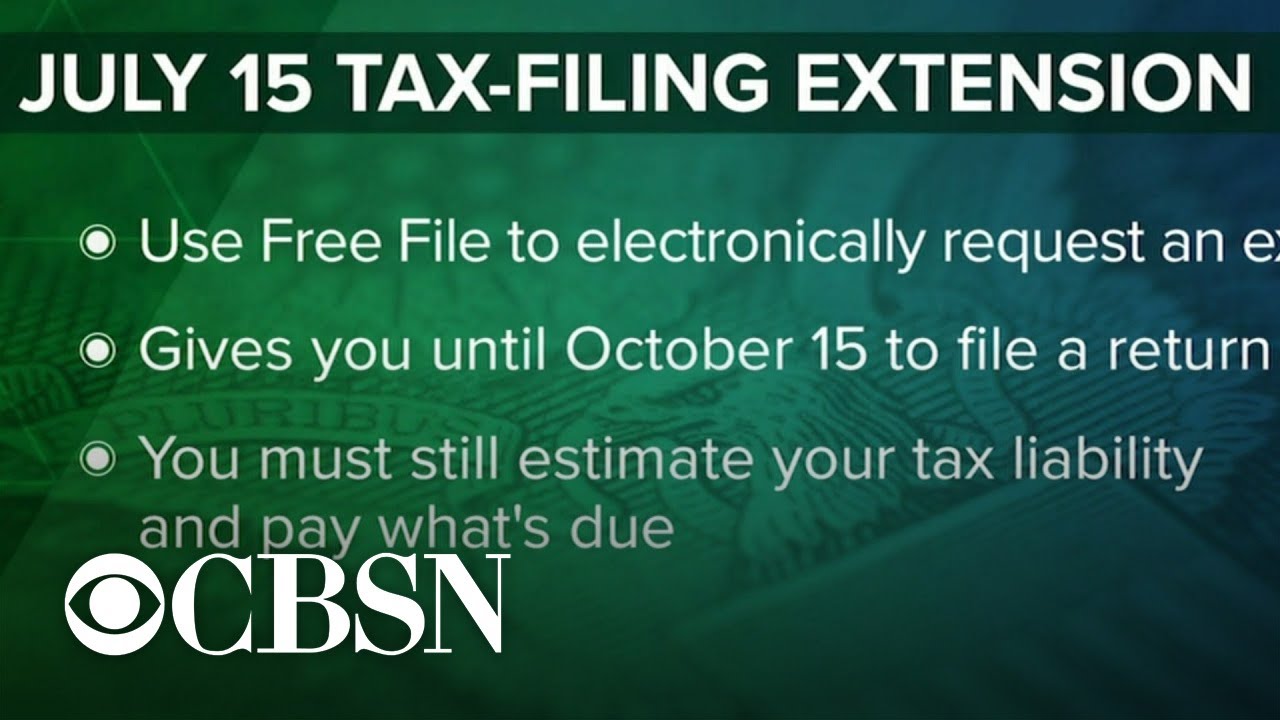

Tax Day, a date that can give anyone the jitters, has some surprising tidbits tucked away in its history. For starters, did you know that April 15 was first established as Tax Day back in 1955? Before that, tax returns were due on March 15. Imagine having a little extra time to prepare! Speaking of time, during Tax Day confusion in 2020, many people realized the IRS actually extended the deadline due to the pandemic — a move that could be likened to Christian Brauns unexpected hot streak in the NBA, where timing is everything. Just like that, understanding the deadline can save you big bucks!

Here’s a fun fact for those looking for inspiration: Martin Luther king Quotes often remind us to take action. His famous words on justice can also motivate us to tackle our finances head-on. Much like preparing to watch a thrilling matchup of Hawaii football, getting your paperwork together can be a game-changer. So, while you’re thinking about your own tax savings, remember that being proactive can lead to a more favorable outcome come Tax Day.

Tax Day Around the World

While we stress over Tax Day in the U.S., other countries have their own quirky ways of dealing with taxes. For instance, in Santiago de Queretaro, Mexico, the tax system can seem like navigating a maze, full of artful techniques that differ by region. It’s a reminder of how unique each culture can be — much like the legendary Von Erich Brothers in the wrestling world, who each had their own signature style!

Moreover, Tax Day doesn’t just impact your wallet; it can even influence some local events. Did you ever think about how Jim Varneys comedic take might have resonated with those filing their taxes? Humor can lighten the burden, much like a community gathering at the Robinson Nature center, where people come together to unwind after a stressful day. So, next time Tax Day rolls around, consider these fun facts, and don’t forget to smile amidst the chaos!