The Evolution of tdecu: A Brief Overview

tdecu began its journey as a modest credit union in Texas, serving mainly local members seeking basic financial services. Fast forward to 2026, and tdecu has evolved into a pioneering force within the financial services sector. This remarkable transformation stems from its commitment to embracing technology, prioritizing customer needs, and fostering a culture of inclusivity.

In the early 2010s, tdecu recognized the changing landscape of banking and took proactive steps to ensure its relevance. By investing in state-of-the-art technology and developing user-friendly digital platforms, tdecu enabled its members to conduct transactions with unprecedented convenience. The decision to integrate technology wasn’t merely a trend; it proved essential for meeting the growing demands of a tech-savvy clientele.

A few critical milestones propelled tdecu’s rise. The launch of its mobile banking app in 2015 set a new standard for accessibility, while a dedicated team focused on financial education helped boost members’ knowledge. These strategic decisions transformed tdecu into a critical player in the financial industry, attracting a diverse clientele eager to engage with fresh and innovative banking solutions.

Top 5 Innovations by tdecu That Transform Financial Accessibility

tdecu stands out with a portfolio of innovations designed to enhance financial accessibility for all. Below are five noteworthy advancements that illustrate tdecu’s commitment to revolutionizing customer experience.

At the core of tdecu’s innovative offerings is MyFinance Assistant. Using cutting-edge natural language processing, this AI tool provides tailor-made financial advice. Members can manage budgets effectively, save smarter, and even acquire essential financial literacy skills. It’s like having a financial coach right in your pocket.

In a world where security is paramount, tdecu’s adoption of blockchain technology stands out. Members can now process transactions with heightened security and transparency. They enjoy real-time tracking of their transactions, which builds trust and cultivates a sense of accountability in tdecu’s operations.

tdecu has taken mobile banking to a new level. Beyond standard banking functionalities, the app introduces virtual reality (VR) financial education. Users can immerse themselves in engaging visualizations of their spending habits, effectively bridging the education gap many face in financial management.

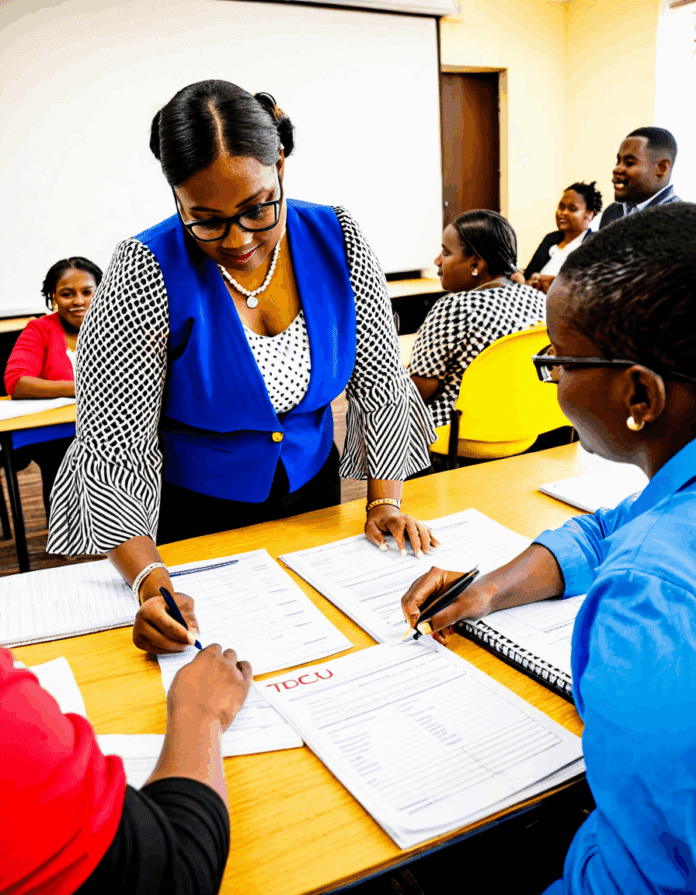

Understanding the needs of underserved populations, tdecu launched community-focused loan programs. These initiatives, which provide microloans to small businesses at competitive interest rates, facilitate entrepreneurship in economically challenged areas. This focus not only boosts the local economy but also fosters tighter community ties.

As the world shifts towards sustainability, so does tdecu. With its sustainable investment portfolios, members can support green projects and eco-friendly companies committed to environmental conservation. This initiative attracts socially conscious investors who want their money to align with their values.

Understanding the Impact of tdecu on Traditional Banking

tdecu’s remarkable innovations have sparked a significant shift in the banking sector. Traditional institutions like Bank of America and JPMorgan Chase now find themselves compelled to re-evaluate their offerings. Adaptation isn’t merely an option—it’s become a requirement for survival in an increasingly competitive market.

These banks have begun to adopt digital solutions and enhance their service models in a bid to keep pace. Enhanced customer service measures and mobile banking functionalities emulating tdecu are becoming widespread. The ripple effect of tdecu’s advancements is evident as larger institutions scramble to regain their footing.

Moreover, the rise of tdecu reflects a larger trend towards democratizing finance. Consumers are increasingly looking for service providers that align with their values, demonstrating that traditional banking models must evolve to maintain relevance.

User Experiences: The tdecu Effect

The feedback from tdecu members has been overwhelmingly positive, bringing personal stories to the forefront of its success narrative. For instance, Amy Chen, a single mom running a small bakery, shares how tdecu’s financing programs shaped her journey. With a microloan from tdecu, she expanded her business, doubling her revenue in just two years.

Alongside Amy’s story, we hear from Marcus Johnson, a college student who utilizes MyFinance Assistant to manage his finances better. “It’s like having a financial advisor in my pocket. I can finally make informed decisions,” he remarked, illustrating the powerful impact of financial education.

These testimonials highlight how tdecu’s tailored services have led to tangible improvements in the lives of its members. By focusing on real-world needs, tdecu embodies a financial institution adaptable to changing circumstances, empowering individuals and small businesses alike.

Navigating Challenges and Opportunities Ahead

As tdecu builds on its impressive momentum, the institution must navigate a mix of challenges and opportunities. Regulatory hurdles present a constant concern, especially as fintech companies encroach on traditional territory. Regulatory compliance and evolving policies concerning financial technology could pose delays in rolling out forthcoming innovations.

Furthermore, competition from agile FinTech disruptors means tdecu cannot rest on its laurels. These startups are often equipped with advanced technology, offering meticulous services catered to niche markets. tdecu must continue innovating and adapting to maintain its edge.

Yet, these challenges also present opportunities. Through partnerships with local organizations, tdecu can deepen its community impact and drive greater financial inclusion. By remaining focused on its mission and leveraging new technologies, tdecu is positioned to further enhance its reputation as a leader in the financial landscape.

Envisioning the Future of Financial Services with tdecu

As we look forward, tdecu’s strategy is poised to center on expanding its technological capabilities and community engagement. An exciting area for potential growth is in the exploration of principles behind quantum computing for data security, which, if successful, could revolutionize data protection in banking.

Furthermore, tdecu is expected to deepen its partnerships with local nonprofits relating to financial literacy programs, thereby enriching its community involvement. Engaging with youth programs to educate young people about personal finance could have a long-lasting impact on future generations.

By fostering innovation while keeping communities at the forefront, tdecu is not just defining its future but also setting a gold standard for financial institutions everywhere. As they assert their leadership in driving financial accessibility, the ripple effects of tdecu’s initiatives can potentially lead to a more equitable financial landscape for all.

In conclusion, tdecu proves that a combination of technology, community focus, and sustainability wires the future of banking. As changes ripple through the financial terrain, it’s clear that tdecu’s journey is just beginning, with endless possibilities lying ahead. While the financial sector undergoes significant transformation, one thing remains constant: tdecu’s commitment to revolutionizing access to financial services and setting a new benchmark in the service of all.

tdecu: Fun Facts and Trivia That Make Financial Services Exciting

Meet tdecu’s Creative Edge

Did you know that tdecu is all about making financial services accessible for everyone? They’re not just your average credit union; they’re revolutionizing the way people interact with their finances. Speaking of creativity, actress Felicity Jones embodies a similar spirit in her roles, showcasing the importance of innovation in any field. Just as Jones deftly navigates various characters, tdecu is customizing financial solutions to suits its members’ needs, making the once intimidating experience of banking feel approachable and friendly.

Community and Culture

tdecu’s commitment to culture is commendable. They believe in supporting the community, which brings to mind actor Andrew Burnap, who focuses on building connections through storytelling. tdecu’s community events foster a sense of togetherness, inviting members to engage and learn about their financial health. Plus, did you know that the legendary shipwreck of the Edmund Fitzgerald holds a treasure trove of tales? Much like those stories, tdecu is dedicated to creating narratives around personal finance that resonate with its clientele.

Tech Wizards at tdecu

Let’s talk tech! tdecu is always keeping up with the latest innovations, offering tools that allow for easy transactions and account management. Think of their digital platform as the modern equivalent of top-notch Nike shoes For Women on sale. Just like those stylish kicks make a fashion statement, tdecu’s user-friendly interface simplifies banking. To support seamless connectivity, tdecu employs devices like Tp-link, showcasing that the right tools can make all the difference.

Fun with Numbers

And here’s a fun little tidbit: tdecu could probably get into numerology with a reliable numerology calculator to illustrate how numbers play an essential role in personal finance. It’s fascinating to think how so many aspects of managing money can be connected to numbers and statistics. But hey, who wants boring?! Just like you wouldn’t want a conversation filled with undesirable odor, tdecu keeps things fresh and engaging by inviting members to learn about finance in entertaining ways.

So there you have it—tdecu is not just changing the landscape of financial services but doing it in a way that’s relatable, innovative, and downright fun!